If anything good were to come out of the coronavirus outbreak for the mortgage industry, it is that the pandemic was a catalyst that finally drove broad-based industry acceptance of e-mortgages, e-notes and digital closings.

"It has incredibly accelerated both the interest and the need for digital mortgages," said

Indeed, "digital closings went from a nice-to-have to an imperative pretty much overnight," said Camelia Martin, the managing director, e-mortgage services, for Falcon Capital Advisors.

"And the conversation [about digital] went from borrower experience and operational efficiency to operational necessity and business continuity."

RON acceptance

There are emergency state orders enabling remote online notary — a key part to closing a mortgage while maintaining social distancing. Title insurance underwriters and the secondary market have also relaxed guidelines involving RON, but there are still a number of hurdles that exist, Martin said. For instance, it is one thing to be able to electronically underwrite a mortgage, but it is another to be able to record it.

RON acceptance is still only on a

On the federal level, the bipartisan Securing and Enabling Commerce Using Remote and Electronic Notarization Act of 2020 has yet to even be considered by the Senate Judiciary Committee. But mortgage closings must still take place.

In theory, a lender can do a RON eclosing

"The key question that determines RON is whether the investor will purchase a RON-signed e-note (for Fannie Mae and Freddie Mac, that's now 42 states plus the District of Columbia), and whether the county recorder will erecord a RON-notarized deed of trust," he said. "If the SECURE Act passes, ensuring national coverage for RON, it would certainly help adoption by providing all players with broader assurance in RON e-closings."

The need for speed

As the industry awaits that federal approval, luddite lenders are rushing to adopt systems that employ RON and other e-docs as quickly as they can.

"Some folks are going to do this so quickly that it's going to be not fully operationalized," Martin said. "So it will be a 'bubble gum and scotch tape' effort. They are going to have to step back and say, 'How do I do this and make sure I made this scalable in a way that is going to prevent things from breaking down or getting done incorrectly?’"

Going digital cannot happen overnight. Before the crisis, the minimum time for eOriginal to onboard a client to do digital closings was six weeks — and longer for a larger firm, said CEO Brian Madocks.

On April 16th, eOriginal rolled out a program that gets a lender set up with all the digital closing essentials in as little as two weeks.

"A lot of people would like to see that practically overnight, but we all know that's not possible," said Madocks, who added that the digitization process can stretch from two to four or eight weeks depending on the level of customization the client wants. Many firms can get up and running with the out-of-the box in two-week models, and get further customization integrated over the following four to six weeks.

One competitor has a similar timeline for boarding.

"Key to implementing a smooth e-close process is ensuring the lender's workflow is well thought out ... which we hold our clients' hands in doing," said Brian Pannell, senior implementation executive at DocMagic. "That includes ensuring all docs are e-enabled and leverages a single-source platform with both hybrid and RON capability. We can implement a completely digital, and fully paperless total e-close in 17 days and e-enabled dynamic docs is critical to that."

Pannell added that within a 24-to-48 hour period, the firm can set clients up for hybrid e-closes that include e-signing and ancillary docs.

Over at Docutech, existing clients that create documents through the ConformX engine can have Solex e-closing turned on in as little as two days for testing and in two weeks to start generating e-notes.

Digital takes hold

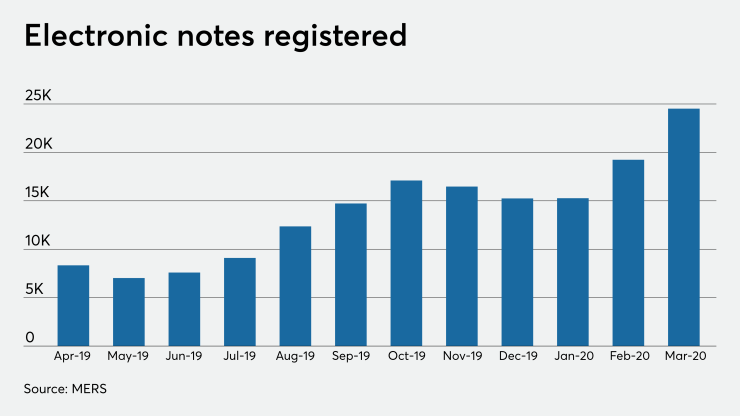

Even before the coronavirus, the growth in

In April 2019, just 8,338 e-notes were on the MERS e-registry. In March 2020, that number hit an all-time high of 24,519, noted Chris McEntee, who is president of ICE Mortgage Services, the parent company of both MERS and e-recording network

"We had significant growth from February, when we started to see a ramp. This ramp was part of a context where the industry was starting to get more and more digital," McEntee explained. "And now there has been this surge, which we've been able to support and deliver against."

Meanwhile, Simplifile recorded its one hundred millionth document on April 1, he said. It added more than 2,400 submitters to its network during March. On the other side of the transaction, the network covers 2,073 participating county recording offices, representing more than 80% of the U.S. population.

To McEntee, there's no turning back for the industry.

"I can't envision a point where we would revert back to what the old standards were because the industry is slower or because wet signatures are more legally defensible," he said. "I think we have to get to the era of where we understand every other industry's gone fully digital and the mortgage industry is struggling to go that direction."

After doing all this work to get to doing digital mortgage transactions, few, if any, originators will return to the old processes.

"Any lender, servicer, other mortgage firm out there that thinks when this over they'll go back to the old way of doing business, they're not going to be in business," Falcon said. "This is a long-term, permanent transformation of the mortgage industry and so mortgage companies need to think that way about it, at a minimum, to survive the post-coronavirus era."