Commercial mortgage broker Eastern Union announced this week that it has reduced its fees for government-sponsored enterprise loans as part of its formation of a dedicated multifamily group.

The group, which consists of teams in the mid-Atlantic region and the New York area, is charging one-quarter of a point for refinances and half of a point for purchase loans, down from the one point typically charged for each of those types of loans.

"With the explosion of technology, it's much easier to do these transactions and bring down our fee," said Michael Muller, a senior managing director at Eastern Union, based in Brooklyn, N.Y.

"With conventional loans, brokers consistently need to find new lenders, create a market, and deal with the fact that all lenders have their own unique process," Muller said in a press release. "This merger is significantly propelled by the fact that agency loans — and specifically agency refinancings — entail fewer issues and more automation. They can be streamlined."

Eastern Union also has proprietary mobile software that can be used to run calculations used in underwriting, noted Muller, who co-heads the multifamily group with Marc Tropp, a senior managing director based in Bethesda, Md.

Mortgage brokers like Eastern Union source multifamily loans that are funded through a pool of Fannie Mae- or Freddie Mac-approved lenders.

Other initiatives Eastern Union recently launched include a unit that will match lenders with investors interested in purchasing distressed notes.

"We know exactly how lenders think during these types of downturns," Abe Bergman, the company's co-founder and managing partner, said in a press release. "We are in constant contact with banks right now, and we understand their mindset during these challenging times."

Fannie Mae estimates forbearance requests could rise as high as 20% on multifamily loans as a result of the coronavirus and its market and policy impacts.

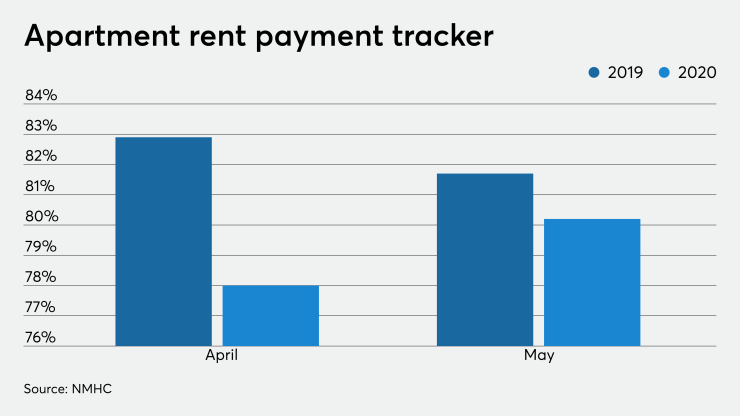

More than 80% of apartment households have so far paid their rent in May, according to National Multifamily Housing Council. The current rental payment rate is only slightly lower than last year's and was up from 78% in April 2020.