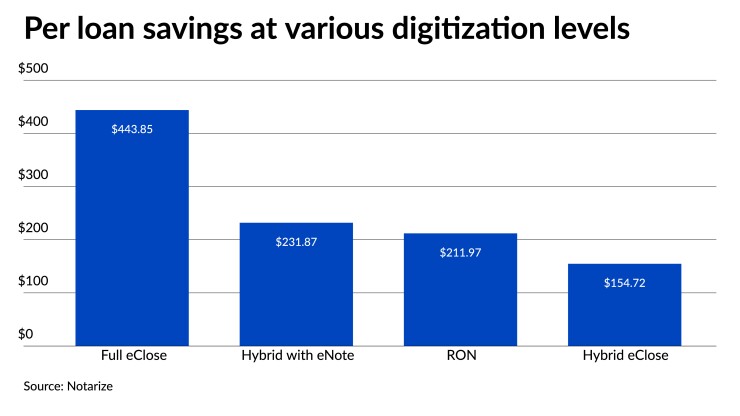

Mortgage lenders can save nearly $444 on their per loan costs if they do a full eClosing, while savings for the title/settlement provider can be as much as $97, a study released by Notarize found.

Participants also reported shorter closings by using online processes, reducing time by 99 minutes for a hybrid eClosing and 157 minutes for a full eClosing.

These savings can be important for an industry dealing with tighter margins. Total production expenses

Even as the pandemic has driven increased adoption of various forms of digital closings, it is still a small portion of the overall market.

Without the push from COVID, it would have been difficult for Minnesota Title to do 20% of its closings using

That pace has now accelerated even further and it is now looking at reaching that goal by the end of March, said Nicholas Dreher, director of series development/industry engagement.

COVID caused all parties to question what had been true in the past.

"The commonly held belief from industry professionals like real estate agents and mortgage people was still you have to be able to go to the closing, we want to celebrate and take the pictures," Dreher said. "But to the consumer, that was just the ancillary noise that wasn't beneficial for them."

Indeed, that provided additional friction because everybody wanted to be present and it had to work for all the schedules.

And making that happen compounded the issues, added Jason Doshi, CEO of paymints.io, which provides fund disbursement services.

For example, he pointed out, incurred costs for a closing include having a notary drive to the borrower's house or another location. And with a delay or a cancellation, and things have to be rescheduled, that just adds to the cost.

Of the $97 savings for a title company, $60.69 was attributed to lender communication, closing time and scheduling and post-closing follow up, the survey found.

Doshi was a former mortgage lender from 2009 to about two years ago. From that perspective "anytime we have a digital solution, the return on investment is there. What really takes time is the implementation and then the consumer adoption."

That's where lenders have to spend both time and money upfront. "Whenever we implemented a solution it was always ‘okay, how many team members do we need to get on this to implemented, what is training look like, how do we educate the consumer?’" Doshi said.

ROI, depending on the method, ranged from $7.73 per dollar invested for a hybrid eClose to $9.86 for a full eClose.

It's a new process, especially for the consumers involved in the transaction, but once they become familiar with it, and they do their next transaction several years later, less education will be needed, further smoothing the pathway, Doshi said.

"Generally using digital solutions, you do save money and provide a better experience over time," said Doshi. "But a little bit of the X factor is the consumer experience as well, that if the client has a good experience, then they're more likely to work with that mortgage company or title company again in the future."

While the pandemic pushed acceptance of RON and digital closings, the related drop in interest rates pushed mortgage activity to record levels.

Ironically that might have hampered acceptance, said Aaron Davis, the owner of Florida Agency Network, a settlement service provider that also uses Notarize.

"From the lender's perspective, they had to make a decision," he said. "Do we focus on eClosing initiatives or hiring more mortgage processors to handle the volume surge?"

So the priority was placed

On average 500 to 800 digital transactions take place per month between FAN and another company Davis owns, Network Transaction Solutions, which provides RON services on an outsourced basis.

The study was done by MarketWise Advisors and looked at the impact of eClosing using RON via Notarize.

"Consumer expectations have shifted to digital-first, and that’s an incredible opportunity for the lender and title industries to be at the forefront of both what consumers want and what is also most financially and operationally efficient," said Terri Davis, general manager of real estate at Notarize in a press release. "EClose is the final frontier of real estate, and we're seeing the incredible ROI, both in the numbers and in consumer feedback, of those who fully embrace eClosing mortgages with online notarization."

Lender cost savings do vary based on how much of the closing process ends up digitized. For a hybrid eClose, the per loan savings is $154.52. Adding RON to that increases the savings to $211.97, and a hybrid close with an eNote generates $231.87 in savings.

Lower error rates also reduce costs to lenders, between $17 and $23 per transaction, depending on the method.

Where savings using RON and eClosings in the future could be seen is for regulatory compliance, said Minnesota Title's Dreher.

While right now it is not being done, these sessions could be recorded and saved. If an issue arises, the recording would provide proof that the rules were followed at the closing table, Dreher said.