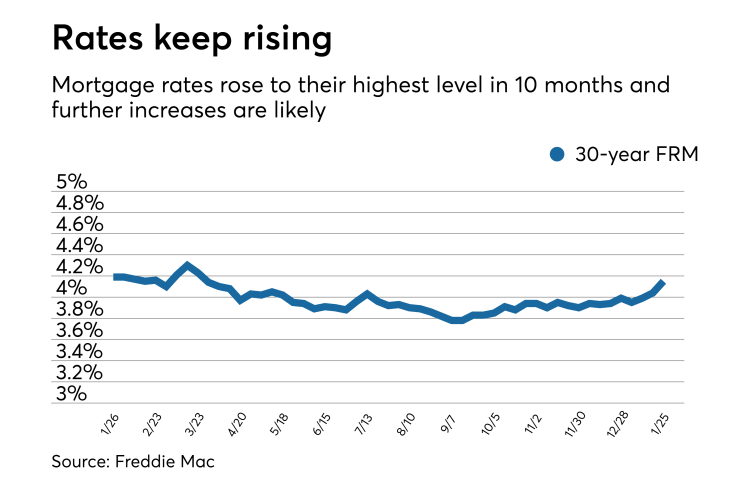

Mortgage rates rose for the third consecutive week and with expected continued economic growth, further increases are likely.

| 30-Year FRM | 15-Year ARM | 5/1-Year ARM | |

| Average Rates | 4.15% | 3.62% | 3.52% |

| Fees & Points | 0.5 | 0.5 | 0.4 |

| Margin | N/A | N/A | 2.75 |

The 30-year fixed-rate mortgage averaged 4.15% for the week ending Jan. 25,

"Rates keep climbing. The 10-year Treasury yield reached its highest point since 2014 reflecting expectations of broad-based economic growth. Mortgage rates, in turn, followed the surge in Treasury yields. The 30-year fixed rate mortgage jumped 11 basis points, its highest level since March of last year," Len Kiefer, Freddie Mac's deputy chief economist, said in a press release.

"The release of the December

The 15-year fixed-rate mortgage this week averaged 3.62%, up from last week when it averaged 3.49%. A year ago at this time, the 15-year fixed-rate mortgage averaged 3.4%.

The five-year Treasury-indexed hybrid adjustable-rate mortgage averaged 3.52% this week with an average 0.4 point, up from last week when it averaged 3.46%. A year ago at this time, the five-year adjustable-rate mortgage averaged 3.2%.

"Mortgage rates have increased decisively in two of the past three weeks, touching their highest levels since March 2017 last week, and the long-term momentum is clearly upward," Aaron Terrazas, Zillow's senior economist, said when that company released its own rate tracker on Wednesday.

"Some of the increase reported late last week may have been associated with the federal government shutdown over the weekend that extended into Monday, which has now been temporarily resolved. Friday's 4Q GDP numbers are the most important economic data scheduled for release this week, but markets could also move if ongoing NAFTA negotiations turn sour.