Loan origination system provider Ellie Mae has agreed to purchase mortgage technology firm Capsilon, citing the growing appeal of artificial intelligence-driven automation and interest in becoming more active as an acquirer.

"With the delivery of our next-generation lending platform, we are accelerating our mission to automate everything automatable for the residential mortgage market. This includes making strategic acquisitions," Jonathan Corr, president and CEO of Ellie Mae, said in a press release about the deal.

"As lenders and servicers continue to shift toward data-driven automation, we are excited to provide automated document recognition, classification and data extraction to further drive down costs and time of loan origination, acquisition and servicing," he added.

The financial terms of the Capsilon agreement were not disclosed. Ellie Mae previously was a publicly held company, but went private after

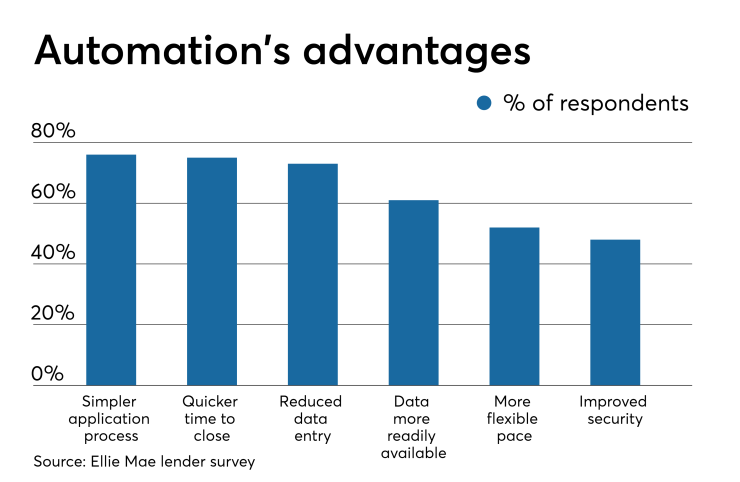

Mortgage lenders, investors and servicers use Capsilon’s AI and data-driven technology to manage workflow, something many lenders in Ellie Mae's recent survey found offered efficiencies. Capsilon most recently introduced an Instant Underwriter, an underwriting engine that automates processes using artificial intelligence and data extraction.

"This will help lenders leverage automation from consumer engagement through investor delivery and servicing," Sanjeev Malaney, CEO and founder of Capsilon, said in the press release.

Sidley Austin served as Ellie Mae's legal counsel on the acquisition and Kirkland & Ellis served as Capsilon's legal counsel. Jefferies served as Capsilon's financial advisor. Jefferies and Kirland & Ellis also respectively served as Thoma Bravo’s financial advisor and legal counsel when the private equity firm acquired Ellie Mae.