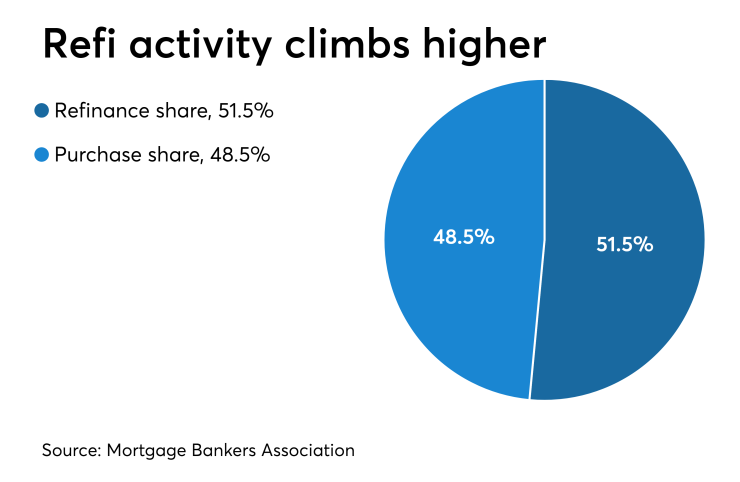

The refinance share of mortgage applications climbed to the highest level since January 2018 as the average 30-year fixed interest rate continued tumbling, according to

The MBA's Weekly Mortgage Applications Survey for the week ending June 21 showed overall applications rose 1.3% and the refinance index increased 3%

"Markets last week reacted to a more dovish FOMC statement and forecast, with Treasury yields falling after the meeting. Mortgage rates dropped again for most loan types, which led to an increase in refinance activity, partly driven by a 9% jump in VA applications," Joel Kan, the MBA's associate vice president of economic and industry forecasting, said in a press release.

The seasonally adjusted purchase index dropped 1% from one week earlier, while the unadjusted purchase index decreased 2% since last week but stands 9% higher

"The 30-year fixed rate has now dropped in three of the last four weeks, and at 4.06%, reached its lowest level since September 2017," Kan continued. "Despite these lower rates, purchase applications decreased 2%, but were still considerably higher (9%) than a year ago. Now at almost the half-way mark of 2019, we have generally seen a stronger purchase market than last year, despite still-tight existing inventory and insufficient new construction."

Adjustable-rate loan activity rose to 6.5% from 6.1% of total applications, while the share of

The share of applications for

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($484,350 or less) decreased 8 basis points to 4.06%. For 30-year fixed-rate mortgages with jumbo loan balances (greater than $484,350), the average contract rate fell 4 basis points to 4%.

The average contract interest rate for 30-year fixed-rate mortgages backed by the FHA decreased to 4.01% from 4.12%. The average contract interest rate for 15-year fixed-rate mortgages fell 10 basis points to 3.4%. Only the average contract interest rate for 5/1 ARMs increased, going to 3.5% from 3.45%.