The Federal Housing Finance Agency has extended Fannie Mae and Freddie Mac’s

There have been several

While a relatively small number of loans go into forbearance in the period after closing but before delivery to the GSEs, it’s a circumstance that can be quite costly for lenders. It’s also particularly burdensome for smaller players with fewer financial resources.

The FHFA also has extended to year-end several

Forbearance rates for the government-sponsored enterprises’ mortgages

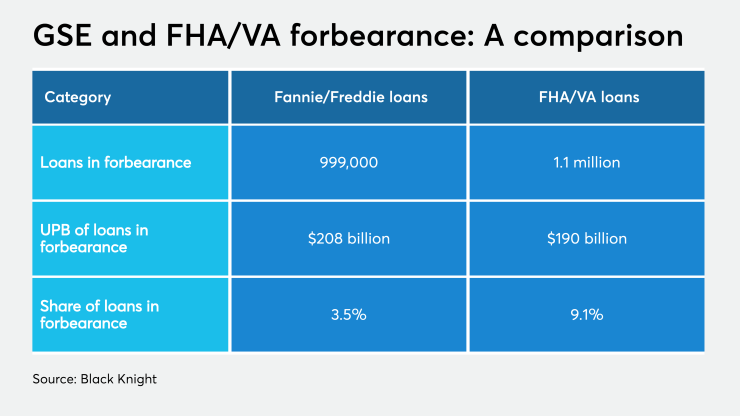

The share of GSE loans in forbearance was 3.5% in Black Knight’s latest weekly snapshot of its daily forbearance tracking data. In comparison, 9.1% of loans insured by the Federal Housing Administration or guaranteed by the Department of Veterans Affairs were in forbearance.

The unpaid principal balance of GSE loans in forbearance is $208 billion, compared to $190 billion for FHA and VA loans. There were 990,000 loans in forbearance at the GSEs and nearly 1.1 million FHA and VA loans in forbearance recorded in Black Knight’s latest report.