The number of mortgages in coronavirus-related forbearance decreased for the 18th consecutive week, dropping 4 basis points between June 21 and June 27, according to the Mortgage Bankers Association.

Home loans in forbearance plans represent 3.87% of all outstanding mortgages, about 1.9 million homeowners. That reflects a decline from

“Strong

Government-sponsored entities saw the greatest decrease loan distress, dipping to 1.99% from 2.02%. It represents the first time Fannie Mae and Freddie Mac forborne mortgages got under the 2% mark since March 2020.

Ginnie Mae loans — composed of

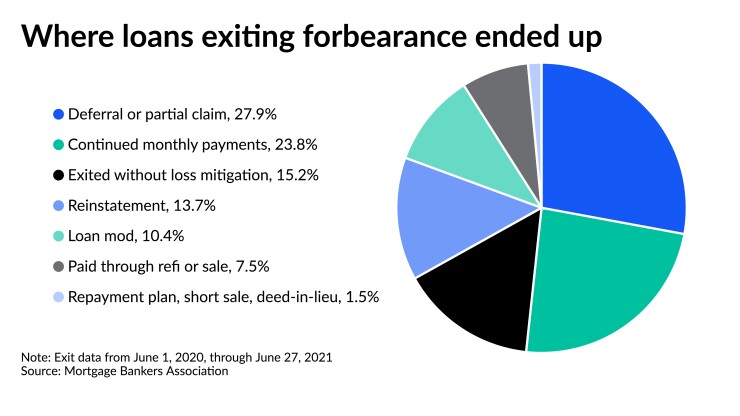

Of all the exits through June 27, 2021 from June 1, 2020, 27.9% ended in deferral or partial claim, 23.8% continued to make their monthly payments, 15.2% exited without a loss mitigation plan, 13.7% were reinstatements, 10.4% modified their loans, 7.5% paid through refinance or sale, and 1.5% entered a repayment plan, short sale, or a deed-in-lieu.

A 10.8% share of all forborne mortgages sit in the initial forbearance stage, 82.9% shifted to extended plans and the remaining 6.3% re-entered forbearance after exiting previously.

Forbearance requests as a percentage of servicing portfolio volume held at 0.04% from the prior three weeks. Call center volume as a percentage of portfolio volume fell to 5.9% from 7.2%.

The MBA's sample for this week's survey includes a total of 48 servicers with 25 independent mortgage bankers and 21 depositories. The sample also included two subservicers. By unit count, the respondents represented about 74%, or 37 million, of outstanding first-lien mortgages.