Rising mortgage rates are taking their toll on the home sales market, leading Fannie Mae to reduce its origination forecast in its latest U.S. economic outlook. Annual price growth is likely to turn negative in the second quarter next year, another factor in their prediction of declining volumes as measured in dollars.

Economists at the government-sponsored enterprise are sticking to their forecast of a recession starting in the first quarter of 2023.

"Over the last few weeks, markets have increasingly — and perhaps reluctantly — reflected the resolve of the Fed to lower inflation via rapid tightening of monetary policy," said Doug Duncan, chief economist, in a press release. "Of course, the slowing effect on the housing market of the higher mortgage rate environment has been largely predictable, and home prices appear to have already begun trending downward."

Fannie Mae economists expect home price declines of 1.5% for 2023, down from the previous prediction of home price growth of 4.4% next year.

"Given the ongoing tension between potential homebuyers and home-sellers at the moment, we believe the pace of sales is likely to slow even further, too," Duncan said.

Home price growth should turn negative on a year-over-year basis in the second quarter of 2023, Fannie said. For the fourth quarter of this year, national home price growth should be 9% up from the same period in 2021. That estimate is down from last month's prediction of 16%.

However, these price declines should not lead to a rerun of the financial crisis, Fannie Mae said in an accompanying blog.

"Due to the minimal use of adjustable-rate mortgages, teaser rates and exotic mortgage products, relatively few current single-family borrowers are subject to payment shocks from rising interest rates in the way many borrowers were in 2006-2008," the post said. "We believe this factor, combined with more robust underwriting standards, as well as a stronger set of tools available for loan workouts and modifications compared to the housing crisis of 2008, will mitigate the impact of home price declines on mortgage delinquencies and

Also, CoreLogic recently made

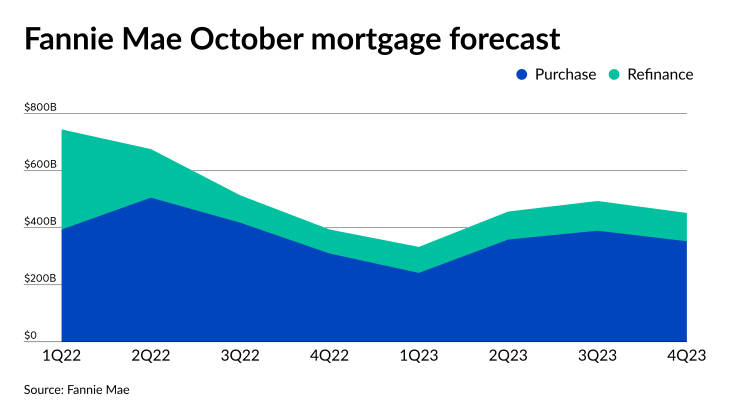

Fannie Mae now expects $2.33 trillion in mortgage originations this year, down from $4.57 trillion in 2021. Purchase volume will end the year at $1.629 trillion, down from $1.9 trillion last year, while refinancings will fall to $701 billion from $2.67 trillion.

For purchase volume next year, the October outlook calls for $1.343 trillion, versus the $1.681 trillion predicted one month prior. Refi originations are expected to fall to $392 billion; last month, Fannie Mae projected $490 billion. To put this prediction in perspective, in the first quarter of this year alone, $351 million of refinancings were originated.

And for next year, Fannie Mae significantly cut its forecast to $1.735 trillion; in September's outlook, the GSE predicted $2.17 trillion in volume.

Total home sales of 5.64 million units for 2022 would be an 18.1% reduction from 6.9 million last year, its October forecast said. Next year, Fannie Mae expects sales of 4.47 million units, a 20.8 drop from 2021. In September, Fannie Mae predicted a 17.2% drop between 2021 and this year and a 12.8% decline between 2022 and 2023.