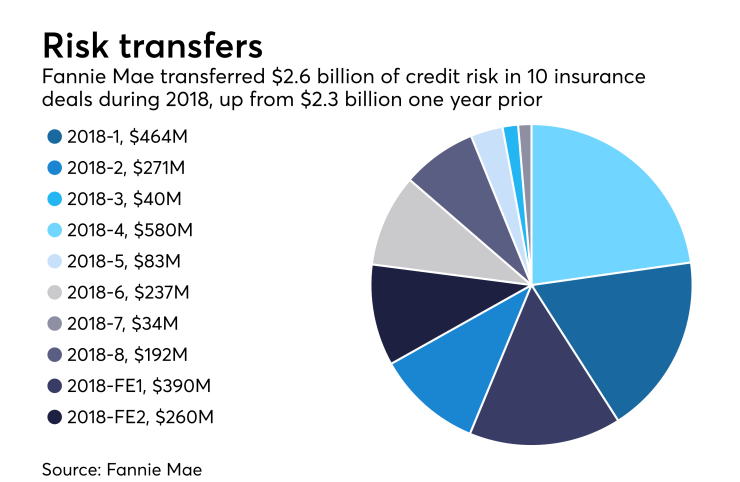

Fannie Mae completed 10 traditional and front-end credit risk insurance transactions during 2018, sharing $2.6 billion of risk, including $192 million in its final deal of the year.

The final deal for this year, CIRT 2018-8, consisted of 15-year and 20-year mortgages with an unpaid principal balance of $12.8 billion.

“In 2018, we entered into commitments to insure over $91 billion of single-family loans through CIRT, transferring almost $2.6 billion of risk through 10 separate transactions," said Rob Schaefer, Fannie Mae vice president for credit enhancement strategy and management, in a press release. "This latest transaction transferred $192 million of risk to twenty reinsurers."

Besides eight traditional CIRT transactions, Fannie Mae did two front-end CIRT transactions that could total $5.5 billion of risk transferred after the fill-up period ends.

To date, Fannie Mae has acquired about $7.6 billion of insurance coverage on mortgages that had an unpaid principal balance of $307 billion through the CIRT program. In 2017, in seven traditional and two front-end transactions, it transferred $2.3 billion of risk.

Both Fannie Mae and Freddie Mac

In the latest transaction, Fannie Mae will retain risk for the first 35 basis points of loss on a $12.8 billion pool of loans. If the $44.7 million retention layer is exhausted, reinsurers will cover the next 150 basis points of loss on the pool, up to a maximum coverage of approximately $192 million. The deal was effective on Sept. 1.

It has a seven-and-a-half-year term and the annual premium is 8.52 basis points. Mortgages in the pool have loan-to-value ratios from between 75% to 97% and were originated between April 2017 and May 2018.

Through various forms including the

Earlier this year, Fannie Mae rolled out another front-end risk sharing product,