Fannie Mae's earnings

However, the government-sponsored enterprise had its worst quarter for single-family mortgage acquisitions

"It's no surprise that the

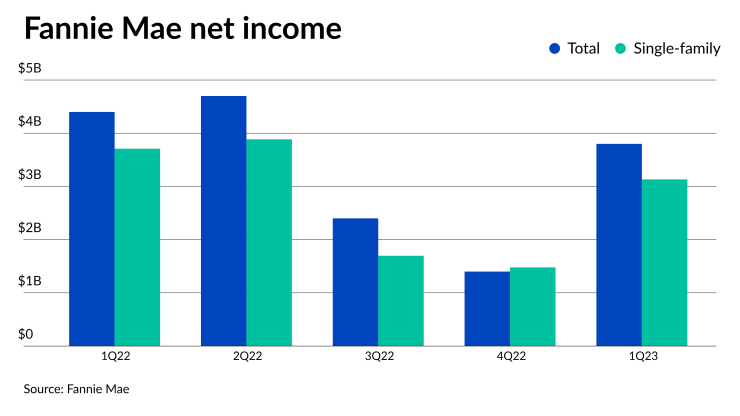

Fannie Mae had net income of $3.8 billion for the first quarter, helped by that $3.2 billion reduction in its credit loss provision. This compared with earnings of $1.4 billion in the fourth quarter and

Its net worth grew to $64 billion as of March 31, from $60.3 billion at the end of 2022. This is because Fannie Mae has been able

While Fannie Mae executives estimated industry single-family originations at $317 billion in the first quarter, that was 21% less than the fourth quarter and less than half from one year prior.

"Reduced volumes constrained lender margins and contributed to the lowest employment levels in the mortgage banking industry since 2020," Almodovar said. "These trends demonstrate notable market pressures on our lender counterparties, a risk that we are following closely."

It only bought $67.5 billion of single-family mortgages in the first quarter, down 21% from $85.3 billion in the fourth quarter. The worst quarter for single-family acquisitions in over two decades was blamed on "the interest rate environment, housing affordability constraints and limited supply," Chryssa Halley, chief financial officer, said on the call.

In the first quarter, Fannie Mae took a $132 million credit provision, entirely related to its multifamily operations; the single-family side actually had a credit benefit.

This was primarily due to the decline in multifamily property values, Halley said. Fannie Mae continued to be concerned, as it was in the fourth quarter, over uncertainty related to its seniors housing loans.

"The single family credit benefit was primarily driven by

The fourth quarter's $3.3 billion provision, besides the senior housing issue, was also based on expected declines in single-family home prices.

However, Fannie Mae's net interest income of $6.8 billion was a drop of $300 million from the fourth quarter, and a result of lower amortization income as fewer mortgages it owns refinanced and paid off early.

"Over 90% of our single-family book, as of the end of March, had an interest rate below 5.5%,

Single-family serious delinquencies of 59 basis points was the lowest level for Fannie Mae since 2005, down from 65 basis points in the fourth quarter and 101 basis points one year ago.

But this should not last, given Fannie Mae's prior stated expectations of

"Based on the macro-economic environment, we expect the credit performance of the loans in our single family guarantee book will decline compared to recent performance, which could lead to higher delinquencies or an increase in our serious delinquency rate," Halley said.

Net income for the single-family segment was $3.14 billion, more than double the $1.48 billion earned in the fourth quarter but below the $3.71 billion reported for the first quarter last year.

The multifamily business acquired $10.2 billion of mortgages in the quarter; that is 13.6% of Fannie Mae's $75 billion cap for the full year. This was $8.4 billion less than the fourth quarter.

This segment reported net income of $640 million, compared with a $52 million loss in the fourth quarter. In the first quarter of 2022, it earned $699 million.

Looking forward, for the rest of the year, Fannie Mae continues to project receiving steady guaranty fee income. Halley added that "we also expect significantly lower amortization income in 2023, compared with 2022, driven by our expectation that refinancing activity will remain low."