Mortgage rates, as measured by Freddie Mac, declined this past week even though the 10-year Treasury yield regained some of the ground lost during the

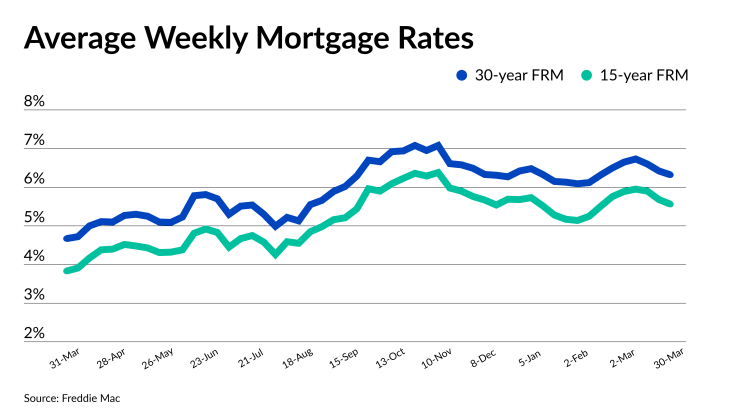

The government-sponsored enterprise's Primary Mortgage Market Survey for March 30 recorded a 10-basis-point decline in the average for the 30-year fixed rate loan to 6.32% from 6.42%

This rate is down 41 basis points since reaching its

At the same time, the 15-year fixed fell to 5.56% from 5.68% a week ago but was up from 3.83% last year.

The yields on the 10-year Treasury opened Thursday morning at 3.56%, up from a close of 3.41% on March 23, as the markets settled from the failures of Silicon Valley Bank and Signature Bank and the rescues of First Republic Bank and Credit Suisse.

"Economic uncertainty continues to bring mortgage rates down," said Sam Khater, Freddie Mac's chief economist, in a press release. "Over the last several weeks, declining rates have brought borrowers back to the market but, as the spring home buying season gets underway, low inventory remains a key challenge for prospective buyers."

More reflective of the changes in the 10-year Treasury was Zillow's rate tracker, which as of Thursday morning, was up 7 basis points to 6.35% from 6.28% the prior week for the 30-year mortgage. Similarly, Black Knight Optimal Blue put the 30-year conforming FRM at 6.446% for March 29 (the last day data is available for), up 11 basis points from 6.337% on March 23.

That increase is reflective of the fact that investors are less worried about the fragility of the banking system, said Orphe Divounguy, senior macroeconomist at Zillow Home Loans, in a statement issued Wednesday afternoon.

"The recent banking sector turmoil ignited fears of a looming

"Those fears seem to be moderating and a number of leading indicators suggest the U.S. economy is still on solid footing" Divounguy continued. "That means inflation may still be slow to come down, leaving the door open for more Fed policy tightening and causing rates to remain elevated."

The next milestone to watch for is the March 31 release of the Personal Consumption Expenditures Price Index.

"Mortgage rate volatility should persist as investors and markets interpret this week's inflation reading from the PCE price index," Divounguy noted.