The extent to which homeownership barriers have grown due to the convergence of rapidly

Home prices grew by nearly 30% since the first half of 2020 with a typical home now coming in approximately $80,000 higher than two years ago, according to a joint analysis by the National Association of Realtors and an industry website. Their report, conducted in conjunction with Realtor.com, also found 57% less for-sale housing inventory than in 2019.

Potential buyers with combined household income between $75,000 and $100,000 can afford only about 51% of those homes listed for sale, down from 58% in 2019 when 656,200 were available to them. Today, there are only 245,300 homes in an affordable range for the estimated 15.9 million households in the income bracket — or one in 65. The Department of Housing and Urban Development calculated

“Due to rising home prices and the ongoing inventory shortage, homeownership attainment will become especially challenging for middle-class buyers unless significantly more entry-level housing units become available,” said Nadia Evangelou, senior economist and director of forecasting of the National Association of Realtors, in a statement. “Otherwise, the wealth gap between middle-income and upper-income households may grow even further.

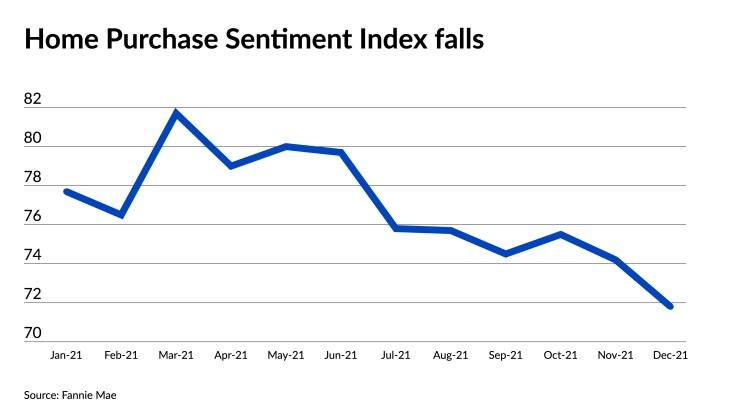

The combined pressure has contributed to further eroding of home-buying sentiment, according to Fannie Mae. In its latest Home Purchase Sentiment Index, Fannie Mae found that optimism toward housing decreased in January for the third month in a row, in part due to the mood among younger generations.

“Younger consumers — more so than other groups — expect home prices to rise even further, and they also reported a greater sense of macroeconomic pessimism,” said Doug Duncan, senior vice president and chief economist at Fannie Mae, in a press release.

The index, which calculates a composite score based on evaluations of consumer survey responses toward home purchases and sales, prices, mortgage rates, job security and income, dropped to 71.8 from 74.2 in December and was down 5.9 points year-over-year. Although

“All of this points back to the current lack of affordable housing stock, as younger generations appear to be feeling it particularly acutely and, absent an uptick in supply, may have their homeownership aspirations delayed,” Duncan said.

In January, Fannie Mae found that only 25% of respondents indicated it was a good time to make a home purchase, down a percentage point from 26% in December to hit a survey-record low. The number who said it was a bad time to buy rose to 70% from 66%, leading to a net decrease of 5% in positive purchase sentiment.

Although homebuying sentiment declined, no reverse uptick occurred when it came toward attitudes about selling, with the percentage saying it was a good time to sell also falling from December to 69% from 76%. Those who indicated it was a bad time increased to 22% from 17% for a net decrease of 12% who said current conditions were good to sell

A bright spot in January’s index was the rise in positive sentiment toward income, with 26% of respondents indicating it grew significantly for them on an annual basis, up from 23% in December. Respondents who reported a large income loss over the previous 12 months fell to 14% from 17%, leading to a 6% net gain in the category.

But increased incomes might not be enough for most households to compensate for the spike in home prices. Wages have only increased by 12% since the pre-pandemic period, according to the combined Realtor.com/NAR report. And even in larger, more expensive cities that became less desirable and more affordable during the pandemic, lack of supply has not made homes

For homebuyers with incomes between $75,000 and $100,000, the likelihood of properties being available for them goes up in the Southern U.S., the report said. The 10 best metropolitan areas with