Home retention actions for loans owned by Fannie Mae and

In the fourth quarter, there were 39,281 home retention actions attributed to the government-sponsored enterprises, down from 61,034

"Defaults have been relatively well under control," said Gagan Sharma, president and CEO of BSI Financial Services, a mortgage servicer based in Irving, Texas. "On the MSR book that we own, defaults are lower than expected. That may be a function of the economy doing well and so consumers just have the ability to stay current on their mortgage."

But no matter if the economy is good or bad, there will always be a percentage of mortgage late payments because consumers run into issues like injury, sickness or job loss.

This happens whether the economy is good or bad, "so we as servicers always need to be ready for that," Sharma said.

The short-term trend for defaults is looking good, which means fewer modifications would be needed.

Now that the holiday season is over and income tax refunds are being sent out, consumers have more funds in their pockets in the first quarter to pay their mortgages. "This time of the year, consumers are getting their tax refunds and have some more liquidity. On the margins that helps," Sharma said.

Some media reports state consumers were disappointed with the size of their refund following the passage of tax reform.

"They may be expecting more and it may be a smaller number but it's still a refund," Sharma said.

Mortgage delinquencies were trending downward, although, for the first time in over a decade there was

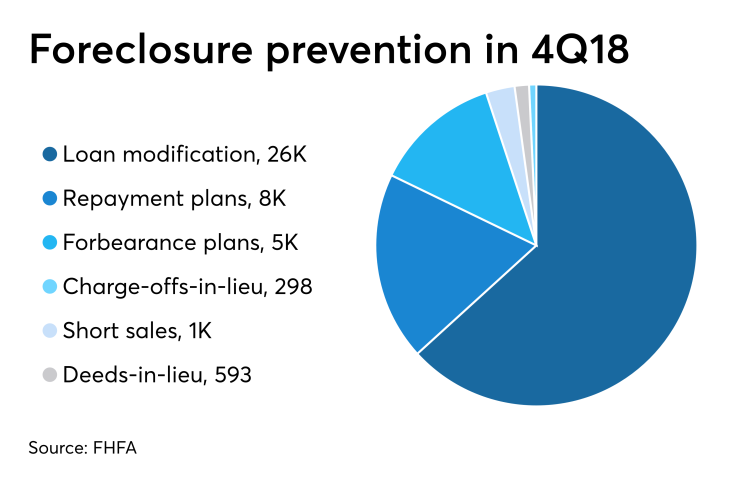

Loan modification activity fell to 25,969 from 49,382 in the previous quarter, the FHFA report said.

However, the number of forbearance plans offered increased to 5,238 from 3,322 in third quarter.

There were also 1,188 short sales and 593 cases where the borrower tendered the deed-in-lieu of a foreclosure, compared with 1,451 and 708, respectively, in the third quarter.

But foreclosure starts increased to 36,002 from 32,557, even as the delinquent inventory shrunk compared with the third quarter. There were 364,333 loans between 30 and 59 days late with their payment in the fourth quarter, compared with 403,463 the previous period, while those loans 60 days or more late fell to 302,211 from 313,626.

For all of 2018, there were 234,263 distressed loans where the borrower was able to retain the home, up from 190,248 for 2017. Total foreclosure preventions, including situations where the borrower voluntarily gave up the property in a short sale or deed-in-lieu transaction, totaled 243,578, compared with 206,898 in 2017.