Home retention actions from Fannie Mae and Freddie Mac through the first three quarters of 2018 already eclipsed 2016 and 2017 while forfeitures kept declining, according to the Federal Housing Finance Agency.

Forbearance plans rose as Fannie Mae and Freddie Mac offered 32,420 of them through the third quarter of 2018 versus

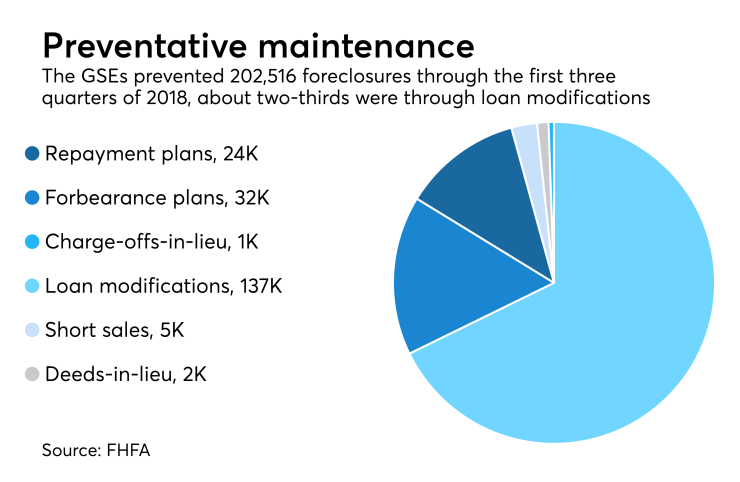

Loan modifications were the widest-used method for borrowers to avoid foreclosure, with 137,206 taking place through the third quarter of 2018. The modification total already surpassed 2017's total of 128,625 and 2016's 123,495.

Principal forbearance, along with a reduced interest rate and an extended term, was used in 24% of the modifications, while 68% had an extended term only.

There were 8,017 repayment plans offered in the third quarter, bringing the 2018 total to 24,240. It's on pace to beat 2017's sum of 30,506.

Conversely, the number of short sales and deed-in-lieu resolutions fell to a combined 7,534. If it maintains that pace to close out 2018, it will continue the downward trend from 16,470 in 2017, 25,784 in 2016, and 35,251 in 2015.

GSE loans between 30 and 59 days late on their payments increased to 403,463 at the end of the third quarter from 354,609 at the end of the second.

However, the number of loans late by 60 days or more dropped to 313,626 in the third quarter from the second quarter's 341,106. Seriously delinquent loans overdue by 90 days or more also fell to 219,182 from the previous quarter's 254,638.

The GSEs' seriously delinquent loan rate decreased to 0.79% from 0.91% in the second quarter. It's much lower than the seriously delinquent rate of 3.7% for Federal Housing Administration-insured loans and 2% for Veterans Affairs-guaranteed loans, the FHFA said.