The Federal Housing Administration mortgage loan limit will increase by approximately 7% for next year, mirroring the rise for conforming loans.

The new limit will be $314,827 for a single unit home in most of the nation, but for some high-cost areas, it rises to $726,525. By law, the floor, or lowest loan limit the FHA can impose is tied to 65% of the conforming loan limit, which the Federal Housing Finance Agency recently

The

The maximum loan limits for FHA forward mortgages will rise in 3,053 counties, but for 181 counties, they remain unchanged.

However, in Alaska, Hawaii, Guam and the Virgin Islands, which have a special exemption, the one-unit property loan limit is $1,089,787.

There is a single nationwide loan limit for Home Equity Conversion Mortgages, and that will rise to $726,525 from $679,650 for 2018. That limit also applies to the states and territories covered by the special exemption.

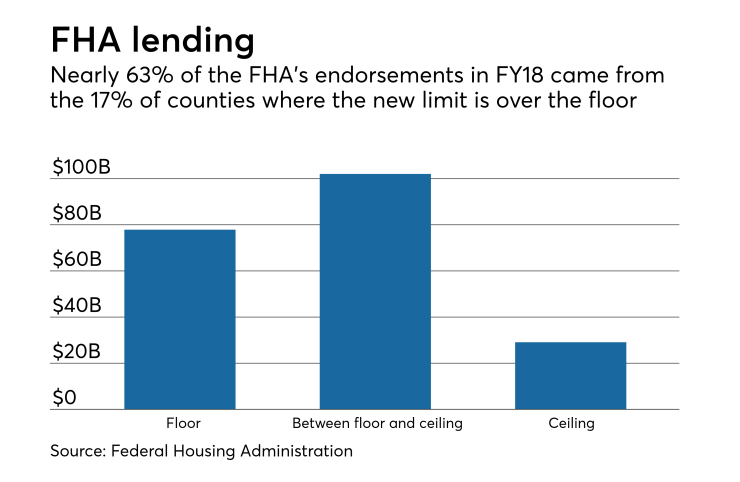

In the 2,657 counties at the 2019 floor, the FHA endorsed 492,860 mortgages, or 49% of all endorsements, during fiscal year 2018. These areas had a dollar volume of $77.9 billion, or 37% of the total. The average loan amount was $158,038.

In the 504 counties where the limit will be between the ceiling and the floor, there were 442,109 endorsements (44%) with a $102.1 billion (49%) dollar volume in fiscal year 2018. These counties had an average loan amount of $230,881.

For the 73 counties where the ceiling applies, just 8% of all endorsements — 79,639 loans — were made in the last fiscal year, with a dollar volume of $29.1 billion, or 14%. The average loan amount was $365,218.