Lenders could be responsible for water quality issues affecting borrowers and properties if the Federal Housing Administration follows through with its response to an inspector general's report.

"Single-family will leverage its strong training program for both lenders and appraisers to ensure the topic of safe and potable water is given appropriate attention in FHA-related lender and appraiser training," said Gisele Roget, deputy assistant secretary for single-family housing, in a written response to the Office of Inspector General's report.

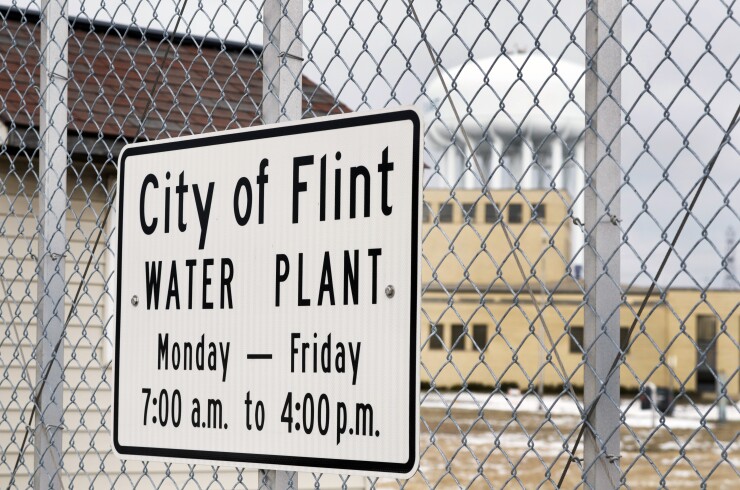

The Department of Housing and Urban Development OIG reviewed a sample of loans for properties where public water utilities had issued notices of lead contamination to the water supply. None of the appraisals accompanying the loan files disclosed the contamination risk or contained evidence of water testing, despite existing HUD policy that lenders ensure properties have access to safe water supplies to qualify for FHA mortgage insurance.

The OIG had called for more drastic retroactive measures in the report.

"We recommend that HUD direct the applicable lenders to provide evidence that the properties for 1,383 FHA-insured loans had a safe and potable water source, or that the appraisers had not notified them of the water quality issue on their appraisals," said regional IG David Kasperowicz in the report.

"If they cannot provide this evidence, direct them to perform water testing and any necessary remediation, or indemnify HUD against future loss."

Roget disagreed with recommendations for retroactive action.

Current FHA policy does hold appraisers responsible for ensuring a property meets minimum FHA requirements, which include "a continuing and safe supply of potable water."

"However, as identified in the audit report, existing single-family policy does not include specific, sufficient guidance for appraisers or lenders to determine when testing should be required for public water supplies," said Roget.

HUD conducted the report as a follow-up to a previous audit last year that found "HUD did not have adequate controls to ensure that FHA-insured properties

Revised policies "are under development," Roget said.