Finance of America Equity Capital, a holding company whose business units are involved in forward and reverse mortgages, commercial real estate and fixed-income investing, is going public by merging with a special-purpose acquisition company.

The SPAC, Replay Acquisition Corp., was founded by Edmond Safra, Gregorio Werthein and Gerardo Werthein. Among Finance of America's current investors is Blackstone Group, which, along with FOA's management will retain 70% of the company after the merger is completed.

"Becoming a public company is an important milestone for Finance of America and provides further access to capital via the public markets over time," said CEO Patricia Cook in a press release.

FOA joins United Wholesale Mortgage by going public

The deal values FOA at $1.9 billion. Top-tier institutional investors have committed to invest $250 million in the form of a private placement at $10 per share of the combined company's Class A common stock immediately prior to the closing of the transaction. Estimated cash proceeds for the deal also include Replay Acquisition's $288 million of cash in trust.

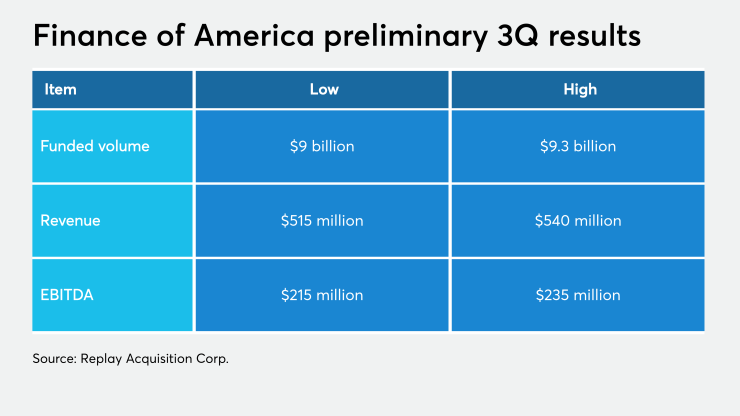

Preliminary third-quarter results provided in a slide show presentation filed with the SEC states FOA has funded volume of between $9 billion and $9.3 billion for the third quarter. Revenue should be in the range of $515 million and $540 million, with EBITDA between $215 million and $235 million.

The net income projection for this year is $391 million, compared with $77 million last year and $47 million in 2018.

In April, its reverse mortgage subsidiary settled

Simpson Thacher & Bartlett is the legal adviser for FOA. Credit Suisse Securities (USA) is capital markets adviser to Replay Acquisition, while Morgan Stanley and Goldman Sachs served as lead placement agents and Credit Suisse Securities (USA) was the placement agent for the private placement transaction. Greenberg Traurig is legal adviser to Replay Acquisition.