Finance of America Reverse developed a new product that combines features of a reverse mortgage with a forward refinance loan.

"With this product, we have created an entirely new category of mortgages we have named 'retirement mortgages.' Technically, this is considered a forward mortgage, but we have created this product to comply with both forward and reverse mortgage regulations to the maximum extent possible," said Kristen Sieffert, the president of Finance of America Reverse. "We are requiring counseling and also providing supplementary disclosures in addition to the normal

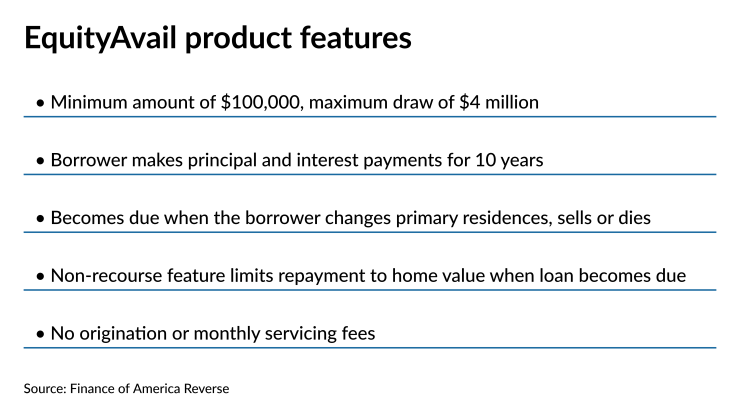

This new product — named EquityAvail — funds at closing and the borrower has to make payments for 10 years but at a reduced amount from their current loan. And like on a forward mortgage, an escrow for taxes and insurance is established.

After that time period, the borrower is no longer responsible for making principal and interest payments, although they are still responsible for taxes and insurance.

Like a reverse mortgage, the unpaid balance becomes payable and due when the homeowner dies, sells the house or it ceases to serve as their primary residence. And because it's a non-recourse loan, the borrower or the heirs will not owe more than the home's value.

EquityAvail has no origination fn ees or monthly servicing fees, and there is no minimum home value qualification.

Because it is a private-label product, the minimum age for a borrower is 60, with a $100,000 minimum amount and $4 million maximum. In contrast, the Federal Housing Administration’s Home Equity Conversion Mortgage has a minimum age of 62 and an

There is a potential market for this product of 2 million borrowers, Sieffert said. The first group of about 1 million people are those over the age of 60 taking out a new 30-year forward mortgage.

But current qualification standards require lenders to underwrite the mortgages only as far as the borrower's ability to make payments for three years. After that period, "if those borrowers encounter financial hardships, such as the loss of a job, and are unable to make their monthly mortgage payments, they are on their own," Sieffert said.

Another one million people in that age group are denied a forward mortgage for insufficient income.

Finance of America Reverse plans to keep these loans in its portfolio with the intention to securitize them at some later point in the secondary market, Sieffert said.

"We intend to retain the servicing rights so we can ensure sustainable and positive outcomes for borrowers well into the future, which is a critical part of our value proposition to consumers," Sieffert added.

It will be available to Finance of America Reverse's wholesale network as well as through its retail channel. The company will provide a concierge desk that can help with the application process, plus online sales tools will be available for originators to plug in a borrower's information and make product comparisons. The rollout is planned for April.