The economic fallout from the coronavirus pandemic has reduced the likelihood of seeing meaningful housing finance reform in the next couple of years, Fitch Ratings said.

In particular, the firm predicts an extended delay on the GSEs' exit from governmental conservatorship.

"The GSEs' ability to raise

The Federal Housing Finance Agency's reproposed capital rule calls for significantly higher charges for delinquent loans. That means Fannie Mae and Freddie Mac may need to have

Fitch said it is unclear how coronavirus-related forbearances will be treated for capital retention purposes in the final rule. The FHFA is soliciting comments regarding this specific area, Fitch noted in its report.

The new FHFA proposal replaced one from former Director Mel Watt, which some felt would leave the GSEs

Fitch echoed comments from other observers who said that the likely return on capital (which Fitch pegged at under 9% based on last year's performance at Fannie and Freddie) would dampen investor willingness to provide funds. And that projection doesn't even take into account the possibility of needing even more capital because of COVID-19 forbearances and delinquencies.

The role of the Preferred Stock Purchase Agreement

Then there is the matter of the legal mechanism through which the government has been providing financial support to Fannie and Freddie: the Treasury's Senior Preferred Stock Purchase Agreements.

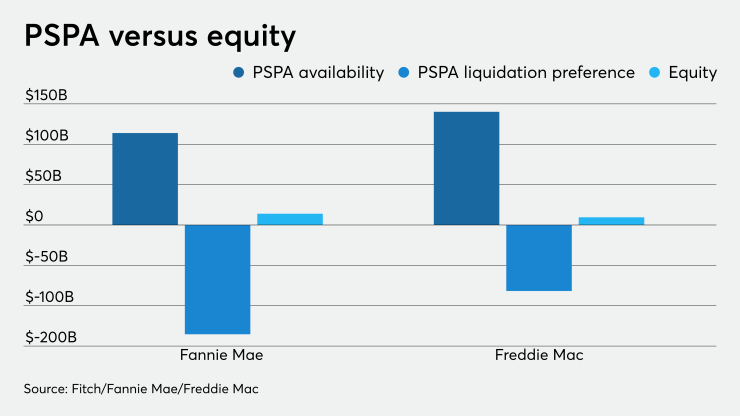

Even though Fannie and Freddie have repaid more to Treasury through the

"We believe there would need to be an adjustment to amounts owed to the senior preferred stock liquidation preference to facilitate a release from conservatorship," Fitch said.

While the Treasury and the FHFA can amend the agreement, the way they might change it could affect current corporate debt holders as well as mortgage-backed securities owners.

If the PSPA was altered to support only MBS issuance, for example, it could affect Fannie and Freddie's ability to do credit risk transfers, since those would be capped at the GSEs' issuer default rating, absent the government's support, Fitch said.

There are broader implications if a revised or eliminated PSPA agreement would address MBS, the report continued.

"If the GSEs were to be released from conservatorship, the PSPAs were no longer in place, and there were no explicit government guarantee on the MBS, there would likely be considerable market disruption due to forced selling of securities by sovereign wealth funds, pension funds, insurance companies, banks and other market participants that would likely upend the U.S. housing market, which remains a large component of the U.S. economy," Fitch said.

"Additionally, without the support of the PSPAs or an explicit guarantee on the MBS, the GSEs may have to get their MBS debt rated. This would likely require the GSEs to overcollateralize their RMBS issuances similar to other private market participants, would raise their funding costs, reduce the level of unencumbered assets and would be credit negative for their corporate debt securities and the GSEs' IDRs."

Because of government support, the GSEs have received AAA ratings. However, on a stand-alone basis, neither Fannie nor Freddie would achieve that rating, no matter how much capital they raised, Fitch said. This is unchanged from Fitch's

"Companies rated 'AAA' on a stand-alone basis are rare. Even if there were a level of capital that would allow the GSEs to achieve an 'AAA' rating, it would likely be uneconomical and could inhibit the GSEs' ability to attract private capital, said Fitch in the latest report.