-

A portion of the proceeds from the offering, announced days following its IPO filing, will go toward the repayment of its mortgage servicing facility.

January 13 -

The industry is now likely to top 2019's nearly $16 billion in premiums written.

December 14 -

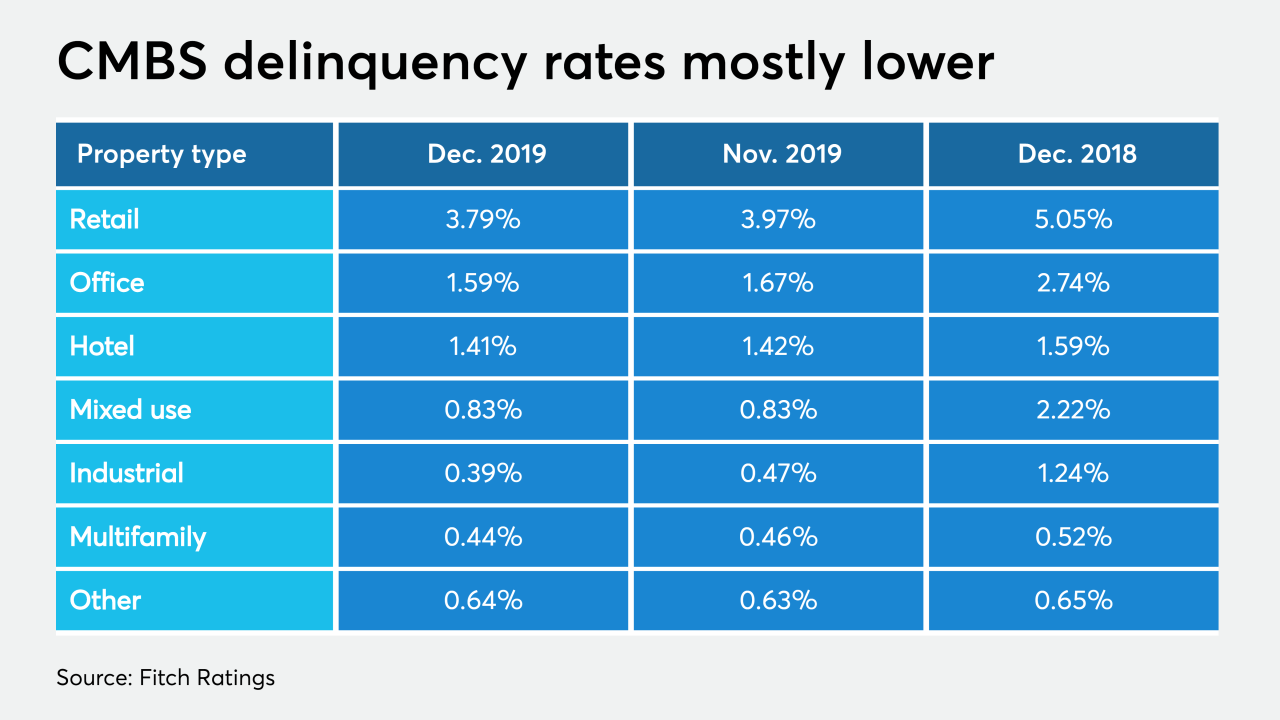

If the tally included loans with some form of payment relief, the rate would be close to 8%.

October 5 -

Delinquencies will rise due to the severe effects of the pandemic on the commercial property sector, Fitch said.

September 30 -

Some of the cures were the result of short-term remedies and could reverse as relief measures end.

September 10 -

Borrowers will likely have to put more assets on the line to get forbearance extensions.

August 13 -

For banks with assets between $10 billion and $100 billion, the average exposure is 165% of capital.

June 24 -

The firm also predicts that the coronavirus pandemic will delay the GSEs' release from government control.

June 3 -

Fitch assumes a significant spike in defaults over the next few months, as well as declining new issuance volume during the second and third quarters of 2020, fewer maturing loans and fewer resolutions by special servicers.

April 9 -

Title underwriters won’t be hit as hard by the coronavirus as other insurers, but related economic changes will challenge them, Fitch Ratings said, in assigning a negative outlook to the sector.

March 26 -

The fallout from the coronavirus could turn a situation in the U.S. where many homes were overvalued into a scenario where prices drop, a Fitch Ratings report said.

March 19 -

The delinquency rate for commercial mortgage-backed securities ended 2019 at its lowest point in nearly 11 years, aided by increased issuance and the resolution of legacy transactions, Fitch Ratings said.

January 10 -

Goldman Sachs is sponsoring a $1.33 billion bond offering backed by commercial mortgages, in the first rated conduit deal of the year.

January 7 -

The United Kingdom’s legal separation of retail deposit-taking from risker activities prevents banks from transferring domestic earnings internally, and the trapped capital has become the catalyst for a mortgage price war.

December 20 -

Fitch may use a new Structured Finance Association framework aimed at prioritizing only riskier TRID errors to assign grades to loans sold into residential mortgage-backed securities, reducing rating-related compliance burdens.

December 17 -

The recent run of lower interest rates may bode well for today's commercial mortgage-backed securities, unless it's undermined by an increase in leverage, according to Fitch Ratings.

September 25 -

Still overvalued — that's the latest assessment of the Dallas housing market by one of Wall Street's big ratings firms.

September 20 -

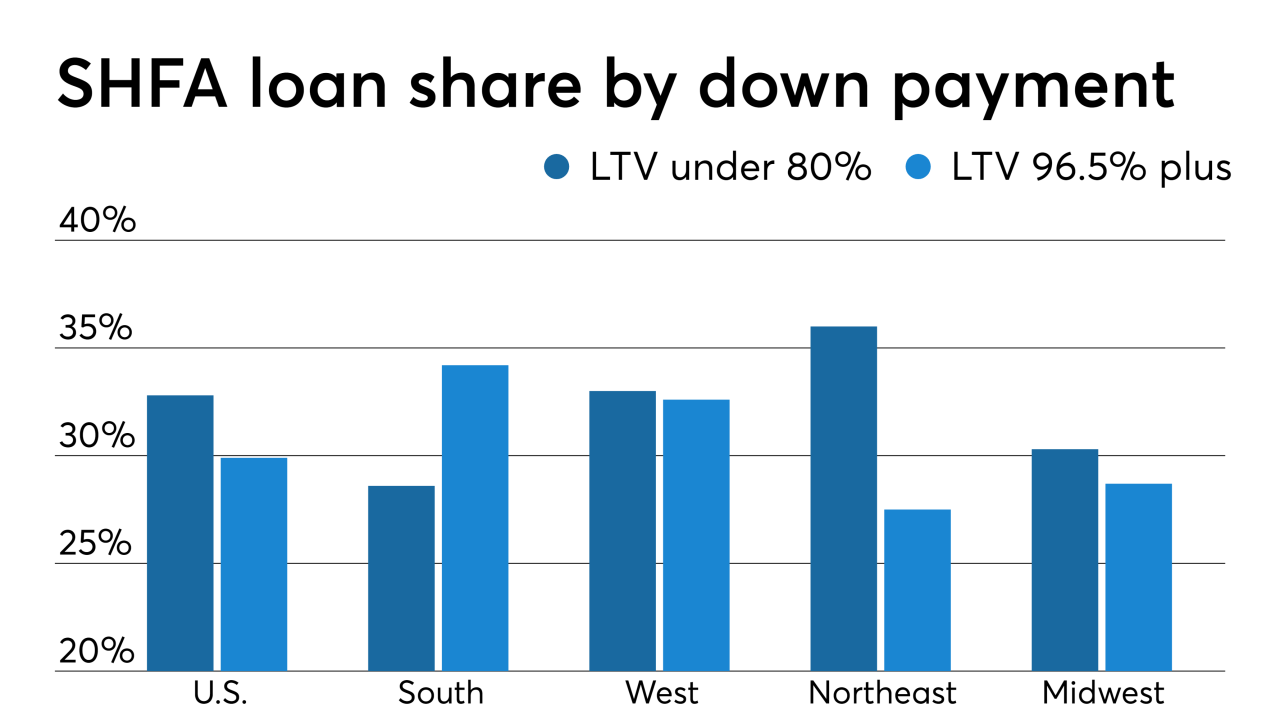

The use of state housing finance agency down payment assistance programs is part of the solution to address the growing affordable housing gap, a Fitch Ratings report said.

September 11 - LIBOR

Trustees are concerned about obtaining proper consents from legacy residential mortgage-backed securities investors in a timely fashion in order to make the switch from Libor to another index, Fitch Ratings said.

August 21 -

Fannie Mae and Freddie Mac's corporate debt ratings shouldn't be downgraded in the near term as a result of the Treasury Department's to-be-released government-sponsored enterprise reform plan, Fitch Ratings said.

August 13