The number of foreclosure auctions conducted is expected to increase 24% in 2023 from the previous year, representing a gradual rise as pandemic-related moratoriums expire, Auction.com said.

The online marketplace predicted 104,000 completed property sales this year, compared with an expected 2022 total of 84,000. However, the increase is still slightly less than half of the 209,000 foreclosure auctions conducted

"As pandemic-era foreclosure protections gradually phased out in 2022, we saw a slowly rising tide of completed foreclosure auctions, not a massive tsunami that

The Mortgage Bankers Association's

On a seasonally adjusted basis, the share of borrowers 90 days or more late on their payment grew to 1.38%, up 11 basis points.

Attom Data Solutions reported

But the demand side for properties sold at foreclosure shifted during 2022, the report found. After hitting what Auction.com termed an all-time high in the first quarter, it scaled down during the remainder of the year.

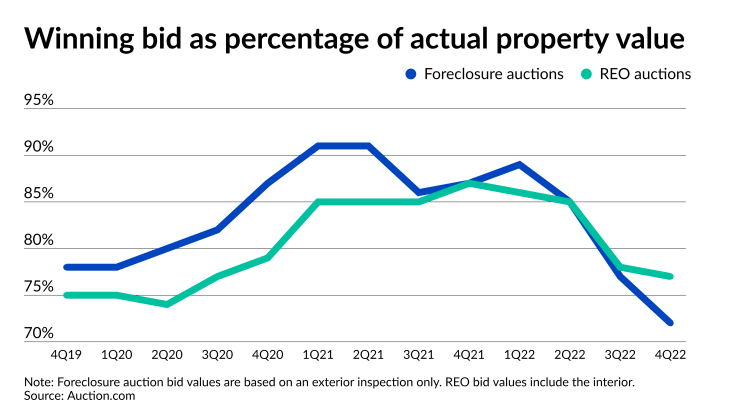

The winning bid as percentage of actual property value fell to 75% in the fourth quarter from a peak of 91% in both the first and second quarters of 2021. Bidders became more conservative in their strategies as they anticipated the

In the fourth quarter of 2019, the last full period before the pandemic hit the U.S., this ratio was 78%. For foreclosure auctions, the ratio is determined based solely on an exterior assessment of the property, as no interior inspection of the home is possible prior to sale.

"I've seen a lot of my competitors just stop buying...expecting prices to go lower, and so they are wait and see," said Francois Delille, a foreclosure auction buyer in the Houston area quoted in the report.

But as mortgage rates start to stabilize in early 2023, the bidding strategy looks to be loosening again.

The bid to estimated value ratio at auction sales of foreclosed properties banks put back on the market fell to 77% in the fourth quarter. The drop was also attributable to buyers becoming cautious in a shifting real estate market. These sales, termed real estate owned (REO) auctions, saw an 87% ratio for the fourth quarter of 2021, while in the same period of 2019, the number came in at 75%. Value calculations for a property sold at an REO auction include an interior inspection, Auction.com noted.

"The distressed market was infused with some of the same exuberance that dominated the retail housing market in 2021 and early 2022, but distressed property buyers quickly returned to more sustainable bidding strategies as the market slowed in response to spiking mortgage rates," said Jason Allnutt, CEO of Auction.com. "Sellers most nimble in this volatile market will produce the best and most responsible distressed disposition outcomes in 2023."

The survey also found 72% of properties sold through a