Foreclosure activity during 2020's first half dropped 44% from the same period in 2019 and 54%

With only 165,530 properties in foreclosure, the first half of the year had the lowest number of such cases over a six-month period since Attom started tracking this data in 2005. Overall, 0.12% all U.S. properties — or one in every 824 — filed in the first half of 2020. Foreclosures reached their peak in 2010, when the rate hit 2.23%.

"The residential foreclosure market across the nation continues to contract amid a combination of booming housing market conditions before the current

"Foreclosure starts and completions were already declining rapidly last year because the housing market and the economy were riding so high. Now they're down to lows not seen for at least 15 years as the federal government has banned lenders from pursuing most delinquent loans until at least the end of August 2020 to help people weather the pandemic," Antebian added.

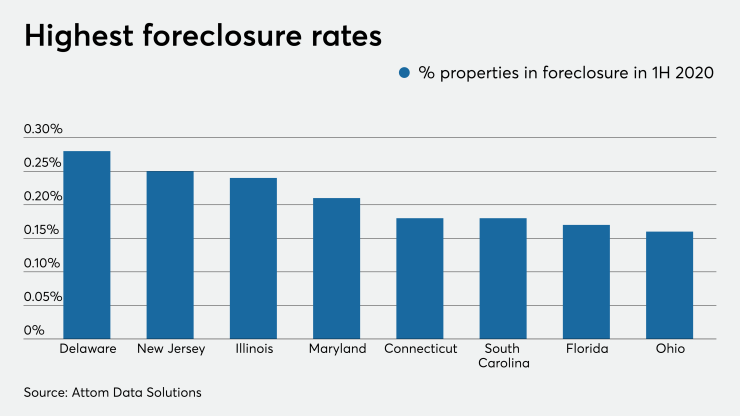

California's 17,913 properties and South Dakota's 28 homes in foreclosure represent the opposite ends of the spectrum in the state-by-state analysis. By rate, Delaware's 0.28% was the highest, followed by 0.25% in New Jersey and 0.24% in Illinois. South Dakota's 0.01% was lowest, trailed narrowly by 0.02% in both North Dakota and Montana. No state posted year-over-year increases in rate.

While down across the board, foreclosures rose year-over-year in 10 of the 220 housing markets with populations of at least 200,000, led by jumps of 161% in Stockton, Calif., 61% in Chico, Calif., and 42% in McAllen, Texas. The highest foreclosure rates by metro area were 0.37% in Peoria, Ill., and 0.36% in both Trenton, N.J., and Rockford, Ill.

"Distressed property volume is almost guaranteed to increase significantly once the moratorium is lifted because millions of Americans missed their mortgage payments in June and will continue to because of unemployment," said Antebian. "But for now, everything is on hold and the foreclosure numbers reflect that pause."

Banks repossessed 37,917 properties through foreclosure during the first six months of 2020. The total fell 44% from 2019 and also marks the lowest half year period since tracking started.

"There are 32 million people on some sort of unemployment insurance. We foresee unemployment landing between 8.5% and 9% at the end of this year and around 7% by the end of 2021," Doug Duncan, SVP and chief economist at Fannie Mae, said in an interview. "Households' ability to recover will depend on the pace the economy rebuilds jobs and income. The longer the household goes into forbearance, the higher the probability becomes that they will need some sort of workout, like a loan modification. Time is often the enemy of bringing things back to current in the mortgage space."