Freddie Mac closed its fifth LIHTC fund since 2018 and will make three investments in affordable housing through a partnership with National Equity Fund.

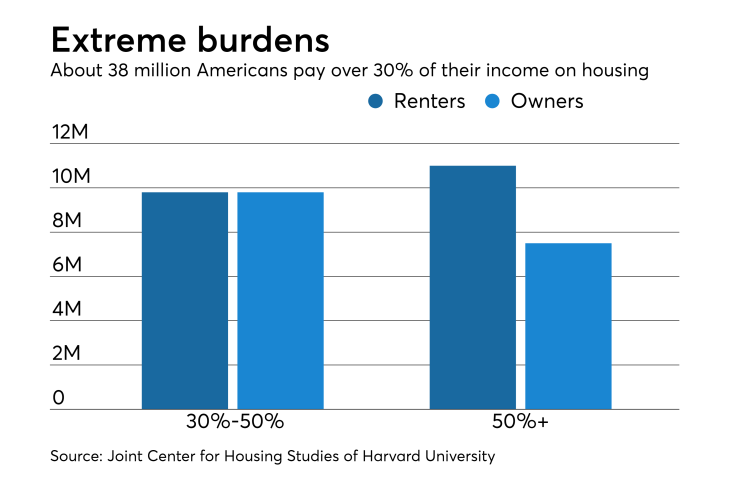

The program combats cost-burdened and extremely cost-burdened households, those that pay more than 30% and 50% of their income on housing. The three investments Freddie's fund managed by NEF already made total $61.1 million.

"We believe that extraordinary things can happen with great partners, and NEF's partnership with Freddie Mac demonstrates that motto to be true," Reena Bramblett, senior vice president of equity placement at NEF, said in a press release. "Freddie Mac's investments provide life-changing opportunities for the individuals and families that call these LIHTC properties home."

The first investment of $15 million went to Houston's New Hope Housing's Dale Carnegie development, supporting 170 individuals and families displaced by Hurricane Harvey.

The next two investments both head to Los Angeles. About $19.6 million goes to Skid Row Housing Trust's Flor 401 Lofts development to help nearly 100 homeless veterans and special needs individuals. The fund gave another $26.5 million to Hollywood Community Housing's Florence Mills Apartments to provide 74 units to support homelessness, with 13 units dedicated for homeless veterans.

"National Equity Fund has a more than 30-year track record of making investments that help the most underserved communities, and Freddie Mac is very proud to aid that mission through one of our LIHTC equity funds," said David Leopold, vice president of targeted affordable sales and investments at Freddie Mac. "The investments we have made through the fund thus far are making a home possible for those displaced by Hurricane Harvey and individuals experiencing homelessness in some of the most housing-challenged communities in the country."

The GSE made its

After exiting the LIHTC market by going into conservatorship in 2008,