-

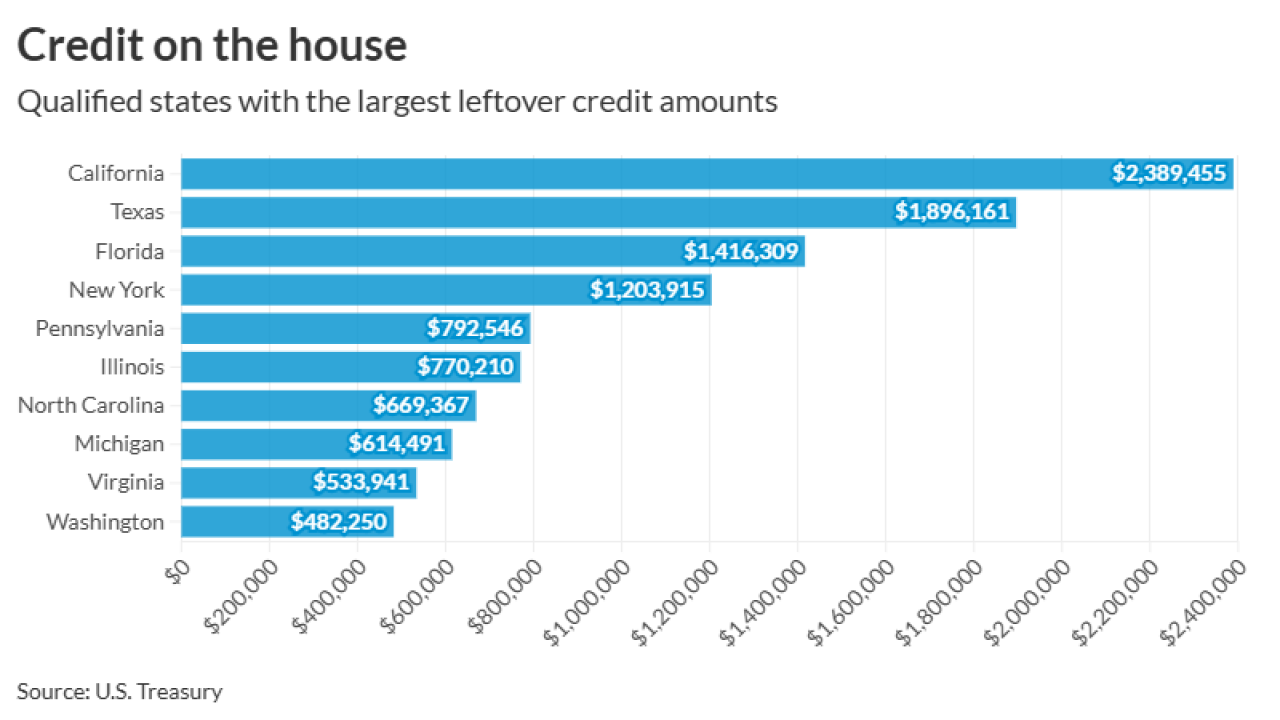

The carryovers range from some $2.4 million in California and some $1.9 million in Texas to $44,851 in Alaska and $39,297 in Vermont.

December 22 -

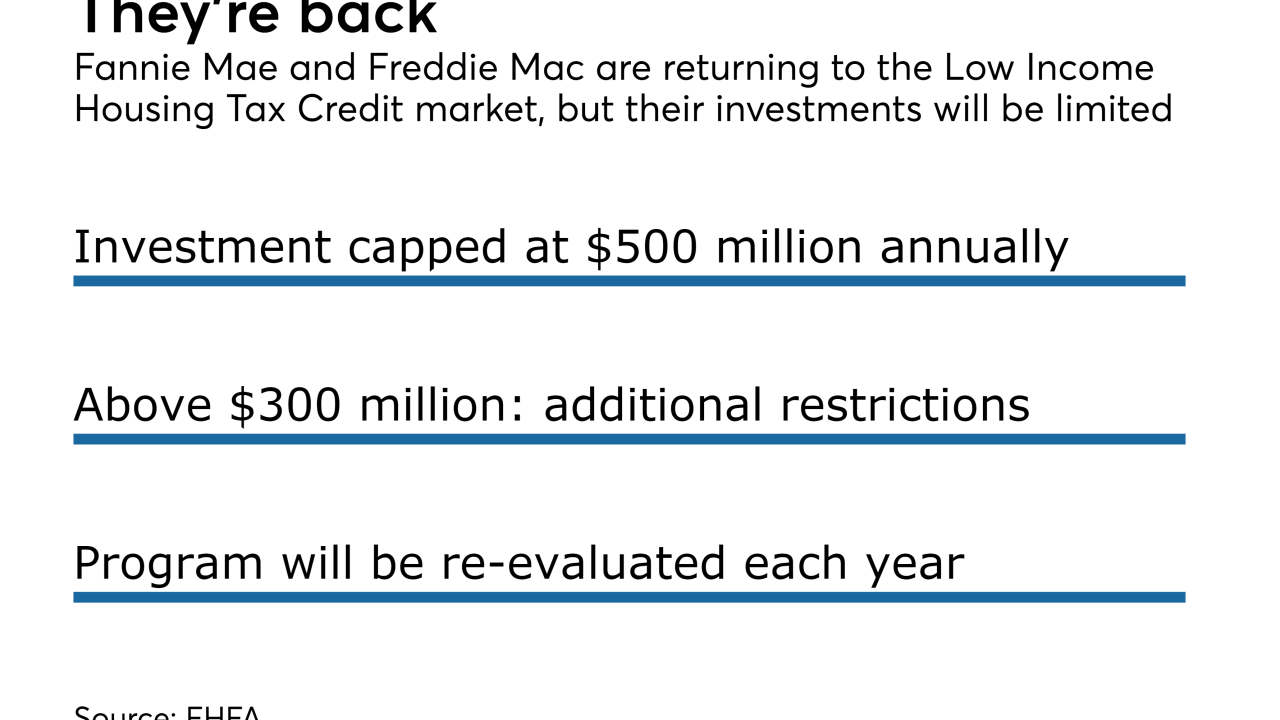

The Federal Housing Finance Agency is now allowing Fannie Mae and Freddie Mac to each invest up to $1 billion annually with certain conditions.

December 22 -

A group of House lawmakers on both sides of the aisle is pushing to expand the Low-Income Housing Tax Credit as the supply of affordable housing remains tight.

November 28 -

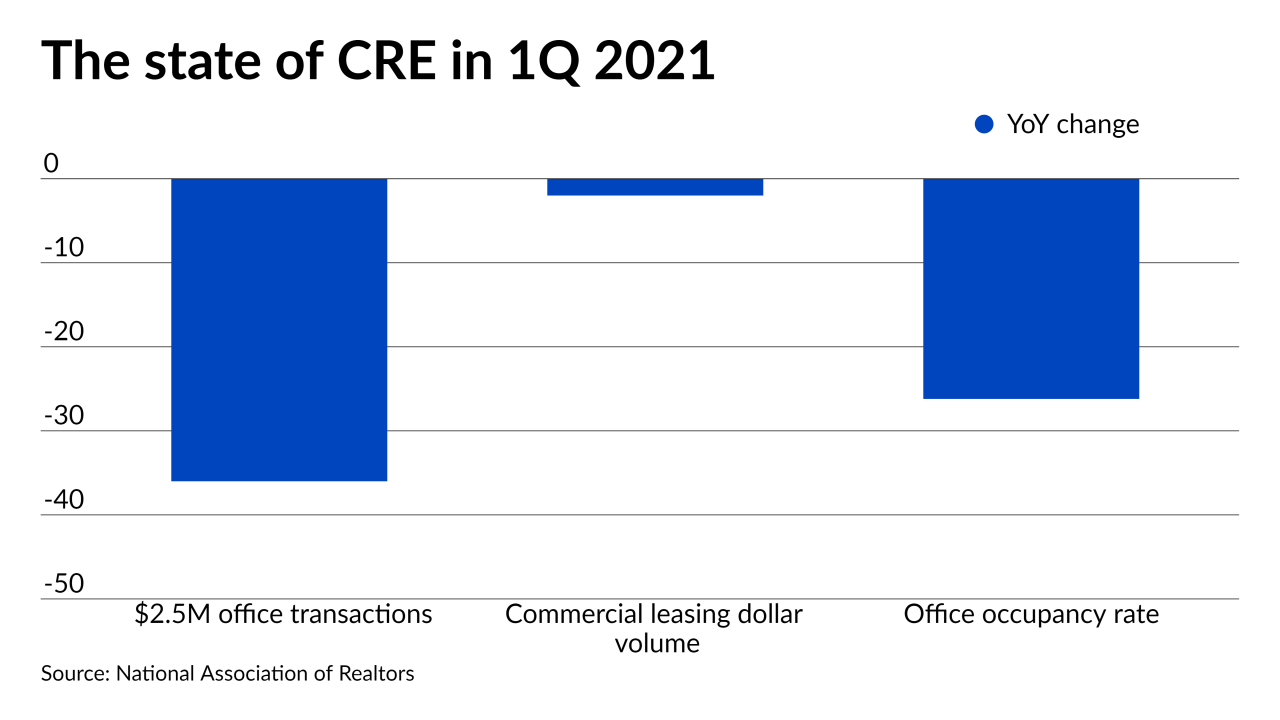

With residential supply severely lagging behind demand, redeveloping unused office space into multifamily properties seems like a perfect solution, but it’ll take governmental collaboration and tax breaks to make such projects financially compelling, developers say.

June 11 -

The credit could cover the minimum down payment for the average Federal Housing Administration-insured mortgage in most large metropolitan areas.

March 16 -

About 140 tracts grew in size by at least 5%, according to census data analyzed by Bloomberg News. Thirty-six expanded by 20% or more.

February 25 -

Plans for a first-time homebuyer tax credit and expanded affordable housing opportunities may be attractive to lenders, but they’re wary of increased regulation.

November 10 -

The proposed changes laid out by banking regulators would clear up confusion about what qualifies for CRA credit within so-called Opportunity Zones. But not all community development advocates are convinced that the changes are for the better.

December 17 -

The bipartisan proposal aims to renew banks' interest in low-income housing tax credits and bring more lower-priced homes to markets that badly need them.

June 18 -

Democratic presidential candidate Julian Castro called for a sharp rise in federal spending on housing for millions of Americans who are living on the street or struggling to pay rent.

June 18 -

Freddie Mac closed its fifth LIHTC fund since 2018 and will make three investments in affordable housing through a partnership with National Equity Fund.

March 4 -

Multiple agencies are looking into its purchase of certain credits tied to low-income housing developments, the bank said in a securities filing Friday.

August 3 -

Lawmakers approved a measure to increase the program's funding by nearly $3 billion over four years.

March 26 -

The FHFA is allowing Fannie Mae and Freddie Mac to invest in the credits for the first time since they entered conservatorship. Its purpose is to promote affordable housing in underserved markets.

November 16 -

The elimination of private activity bonds “would throw gasoline on a housing shortage," said John Chiang, California's treasurer.

November 9