Freddie Mac says it expects that a flattening yield curve will increase its opportunities to expand its credit guarantee business and invest in fixed-rate mortgages this year.A flattening of the yield curve "plays to our traditional strength," Freddie's president and chief operating officer, Eugene McQuade, told an investor conference sponsored by Citigroup. Freddie is forecasting a decline in adjustable-rate mortgage originations in 2006 and 2007 and projects that banks will find it less profitable to invest in fixed-rate mortgages. "While we have yet to see a selloff of fixed-rate mortgages from bank portfolios, even slightly reduced investment by banks should create better fixed-rate buying opportunities for us in 2006," Mr. McQuade said. The Freddie COO also pointed out that most of the growth in the company's mortgage portfolio came from purchasing subprime mortgage securitizations that are rated triple-A. "We generated most of our retained portfolio growth last year in that sector," he said. Mr. McQuade also told investors that Freddie Mac gained market share from Fannie Mae in 2005 in the issuance of guaranteed mortgage-backed securities. Freddie said its share increased from 41% in 2004 to 45% in 2005.

-

Some vendors' voice agents have quoted "outrageously low" interest rates to consumers, among other potential violations, according to one expert.

3h ago -

Originators of the clean energy loans will have to follow stricter lending laws, a move that program administrators say will hike costs and reduce funding.

3h ago -

Federal Reserve Vice Chair for Supervision Michelle Bowman said in a speech Monday morning that the central bank will introduce two capital proposals that she said are aimed at boosting banks' role in the mortgage market.

February 16 -

The Public Interest Law Center filed an amicus curiae brief arguing against a joint motion to end a redlining agreement early against Lakeland Bank.

February 16 -

The mortgage broker trade group put out a white paper calling for lowering transaction costs, increasing housing supply and reducing regulatory barriers.

February 13 -

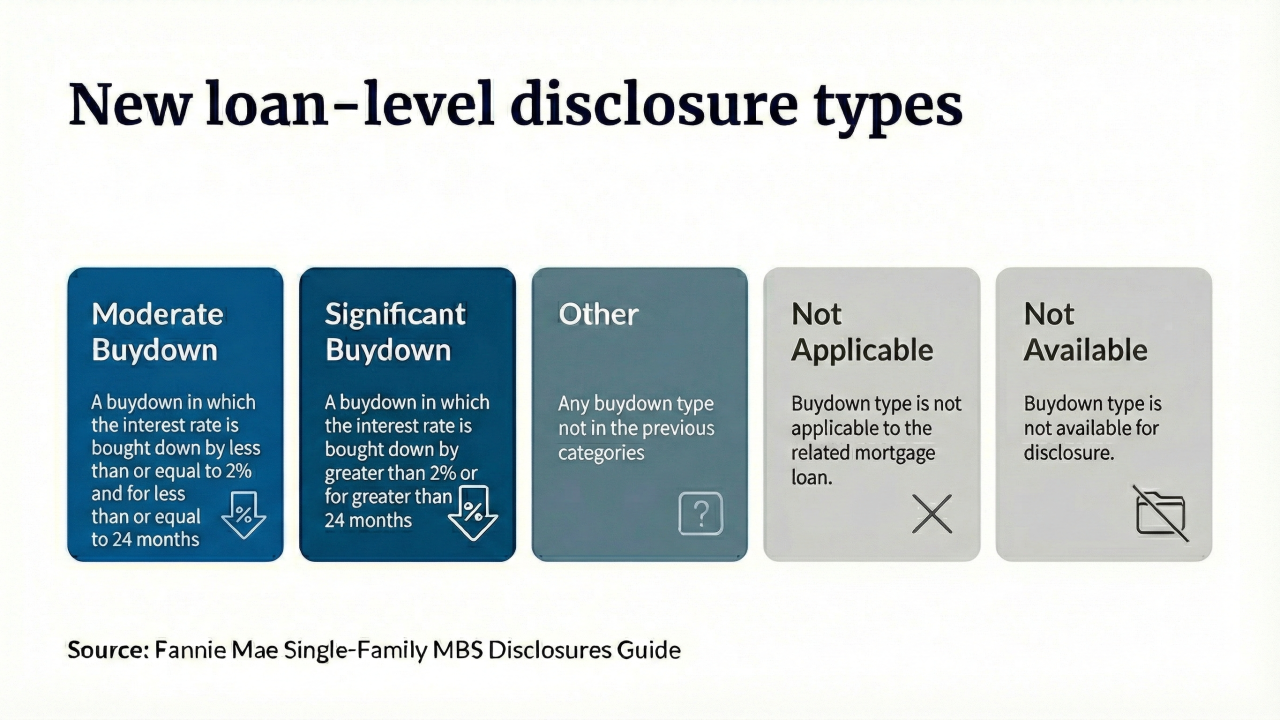

Fannie Mae and Freddie Mac will add loan-level buydown data to MBS this spring, giving investors clearer insight into prepayment risk tied to temporary rate incentives.

February 13