Women are becoming more and more empowered in home purchasing, thanks in part to the digitization of the mortgage and real estate industries, according to a report from Compass and Better.com.

Though the outlook looks far brighter, women still report facing biased practices and an uphill march to homeownership. In Ellie Mae's

"Women are often dissuaded from participating in the home purchasing process. When applying for a mortgage a few months ago, I personally had brokers asking me presumptuous questions about my job — and I even had a few who didn’t believe me," Sarah Pierce, head of sales at Better.com, said in the report. "These types of questions and others like it are as outdated as the phone book and make women feel like they are not welcome to participate in the home purchasing process. I am thrilled to be a part of the industry as it evolves. The rise of digital in real estate has empowered individuals — regardless of gender, marital status or race — to apply for a loan from the convenience of their mobile device."

The rise of fintech

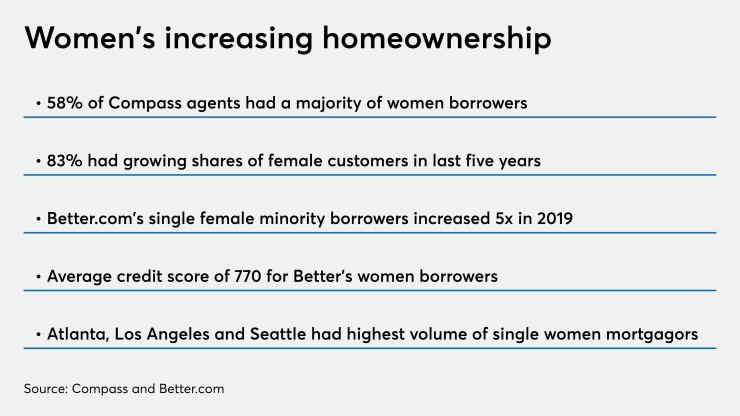

The shift is starting to take. In 2019, about 58% of Compass agents reported women made up the majority of their clients. Approximately, 83% of agents said their share of female customers increased over the last five years and 71% said single women were entering the housing market earlier than single men.

In addition, Better.com saw certain pockets of its female borrowers grow exponentially. Single minority women mortgagors increased by five times last year and those in the 30- to 40-year-old demographic with monthly salaries between $10,000 and $20,000 grew four and a half times. Overall, Better.com's female borrower base had an average credit score of 770.

"Women understand that buying a home is more than securing a place to live, but is an investment in their future that can ultimately be passed on to their family or play a significant role in their retirement," said Atlanta-based Compass agent Monique Williams. "I personally can think of few things more impactful on my life than the equity I have from purchasing my first or current home."

Broken down by metro area, Atlanta, Los Angeles, Chicago, Seattle and Denver saw the highest volume of single women getting mortgages over the last year.