Government mortgage-bond insurer Ginnie Mae will restrict the pooling of certain adjustable-rate mortgages ahead of plans to phase out Libor at the end of next year.

The restrictions on the pooling of loans with any interest term based on Libor will be effective for traditional mortgage-backed securities issued starting Jan. 21, 2021.

For MBS backed by Home Equity Conversion Mortgages, the restriction will begin Jan. 1. Until further notice, participations in pre-existing HMBS with an issuance date on or before Dec. 1 of this year will continue to be eligible for securitization without restriction.

The change is most significant for the reverse-mortgage market, which has relied heavily on Libor as an index.

Both reverse mortgages and traditional ARMs indexed to the constant maturity Treasury index will continue to be pooled without restriction.

Ginnie Mae is ready to insure securitized ARMs backed by the Secured Overnight Financing Rate when insurance of those products at the loan level is authorized by other government agencies.

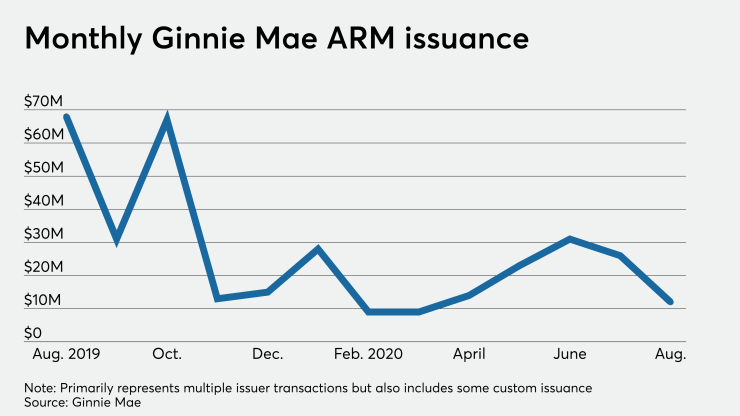

Due to historically low fixed rates and plans to phase out Libor, traditional ARM securitization at Ginnie has declined notably in the past year. It was $12 million in August, down from $68 million during the same month the previous year, and $354 million in August 2018.

In comparison, newly securitized reverse mortgages continue to run at a rate of $500 million to $600 million per month on average, according to capital markets consultancy New View Advisors.

In total, ARM securitization constitutes only a little over 1% of overall Ginnie Mae issuance, which neared $78 billion