Better Mortgage has launched a mortgage refinance program to help federal government employees affected by the

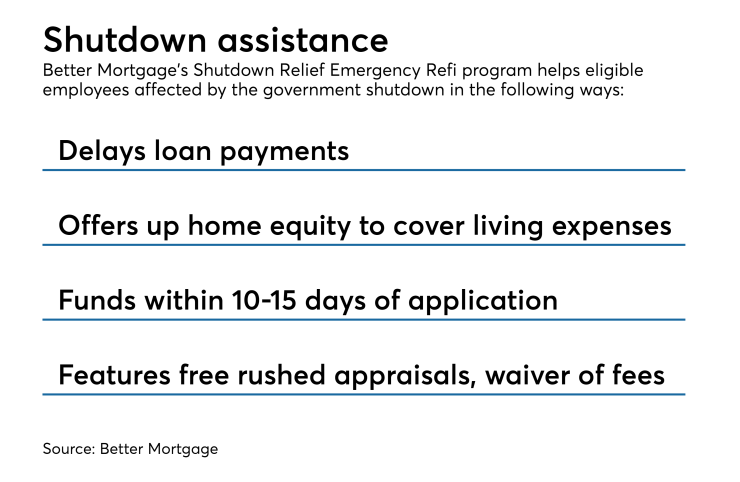

The New York-based lender's Shutdown Relief Emergency Refi offers homeowners an opportunity to live off of their equity while also delaying loan payments for up to 30 days after the end of the furlough, according to Better Mortgage.

Homeowners must have a minimum FICO score of 620, at least 5% equity in their homes and a maximum debt-to-income ratio of 50% to be eligible. Federal workers either furloughed or working without pay as a result of the shutdown may apply, including contract employees.

Eligible borrowers can refinance with or without the cash-out feature and Better Mortgage is offering expedited appraisals and waiving its origination fees. No out-of-pocket expenses will be due at closing, the company said.

"We are dedicated to helping all of those federal employees impacted by the current shutdown. By delaying their mortgage payments and tapping into the equity in their home, we are providing them the added flexibility of covering their normal monthly expenses and minimizing the financial disruption to their lives until the shutdown has ended," Vishal Garg, co-founder and CEO, said in a press release.

The program is accessible in any of the 27 states (and Washington, D.C.) where Better Mortgage is available.