Senate Democrats will be in no mood to compromise on GSE regulatory reform during the lame-duck session if they win control of Congress in the November elections, according to Sen. Christopher J. Dodd, D-Conn."I'm hoping both houses [the House and the Senate] are in different hands the morning of Nov. 8," Sen. Dodd told reporters. "If that is the case, I think we will have a rather short lame-duck session." If the Democrats don't win both houses, the ranking Democrat on the Senate Banking Committee indicated there might be time to negotiate. "It depends on what kind of a lame-duck session it is," Sen. Dodd said after speaking to a Congressional Hispanic Caucus conference. Supporters of government-sponsored enterprise reform are hoping the lawmakers can reach agreement and pass a bill to strengthen the regulation of Fannie Mae and Freddie Mac when Congress returns to Washington Nov. 13 for the lame-duck session. Sen. Dodd contends that Congress could have passed a GSE regulatory reform bill in September if the Bush administration had accepted the House-passed GSE bill. "I think the administration missed an opportunity," he said. "House Democrats and Republicans put together a pretty good bill." The Connecticut senator said he likes the House GSE bill (H.R. 1461) and will try to pass it next year if he chairs the Senate Banking Committee. Sen. Dodd is in line to be the chairman if the Democrats win control of the Senate.

-

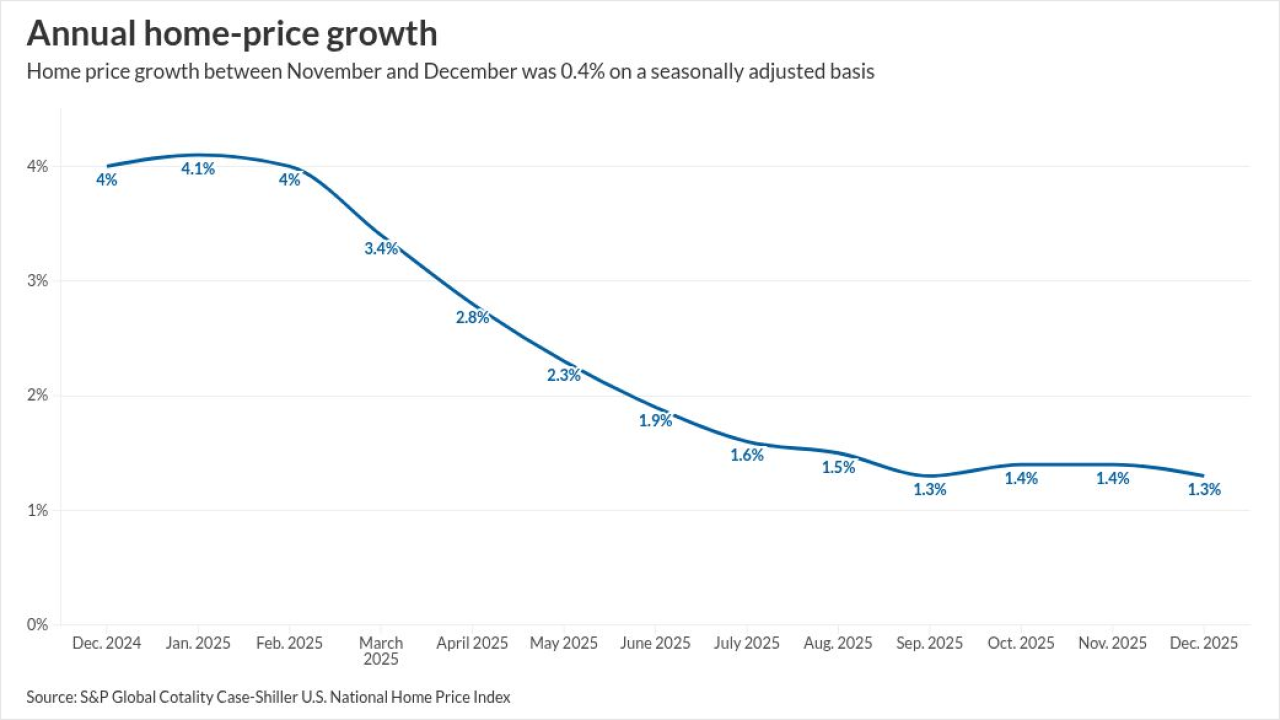

Home prices edged up nationwide, but gains were modest and uneven. Major indexes agree on direction, differ on size, as 2025 posted weak growth.

2h ago -

Federal Deposit Insurance Corp. report shows margins widened and profitability remained high even as credit quality saw some wobbles from consumer and commercial loan portfolios.

2h ago -

Federal Reserve Bank of Chicago President Austan Goolsbee said the central bank should focus on getting inflation to its 2% target before making any additional cuts to short-term interest rates.

6h ago -

Home buyers working with the originator won't have to liquidate their digital assets to access purchase, refinance, second-home or investment loans.

February 23 -

Some mortgage companies are taking advantage of a loan-interest deduction that was designed to benefit community banks, a Washington State legislator alleged.

February 23 -

A median-income household could comfortably afford a $331,483 home with a 20% down payment in January, $30,000 more than a year ago, Zillow found.

February 23