Guild Mortgage’s servicing numbers and concentration on purchases led the company to a nearly fourfold first-quarter income gain, but company officials also indicated layoffs and turbulence lay ahead.

Guild Holdings, parent of the San Diego-based lender and servicer, reported net income of $208 million for the first three months of the year, up from $42.2 million in

“Our servicing platform acted as a hedge with strong growth in servicing fees,” Guild CEO Mary Ann McGarry said on the company’s earnings call.

“However, near-term purchase-market share trends have been impacted by limited inventories, rising interest rates and increased competition,” she added.

To combat the slowdown, officials hinted at staff reductions, which would add to the wave of

“As is typical for the mortgage industry during declining volume cycles, we are in the process of curtailing excess capacity in our retail workforce, with an ongoing focus on maintaining strong profitability across cycles,” said Amber Kramer, Guild’s chief financial officer. The company provided no additional details on numbers.

As

“Despite declining origination volumes, the UPB of our servicing portfolio consisting primarily of MSRs sourced through our retail channel was up 3% quarter over quarter to $73.3 billion, driving strong growth in servicing fees and related earnings contribution,” said Terry Schmidt, Guild’s president.

Net income from originations also increased from the previous quarter, bucking trends

Guild’s business model, which is more heavily weighted toward purchases compared to the industry average, likely helped the company stave off a more severe impact in originations from the current market environment. While refinances have dropped off rapidly, purchases showed less volatility throughout much of the winter, and

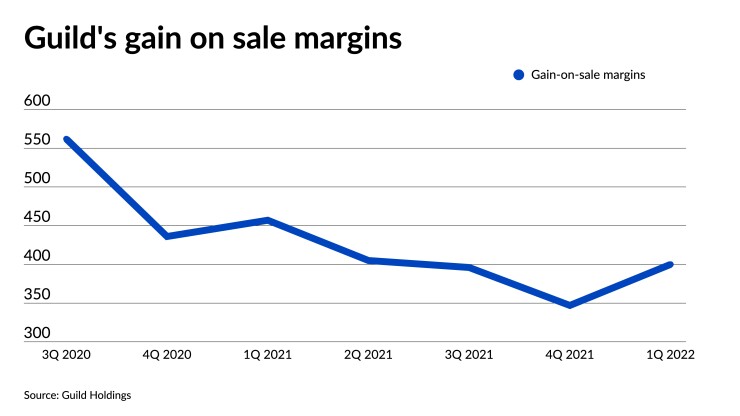

Gain-on-sale margins on originations increased to 400 basis points from 347 bps in the fourth quarter, but company officials cautioned the quarterly growth could not be seen as a reliable signal of where the market was headed. While

“If you look at the margin on pull-through lock-adjusted volume, that's the best indicator of the continued margin pressure, and we're just not seeing from a competitive-pricing standpoint that we're necessarily near the bottom,” Kramer said.

“Until we rightsize and the markets stabilize, that continued pressure is going to continue,” she added.

Net revenue generated by Guild in the first quarter totaled $481.9 million compared to $343.1 million in the final three months of last year. Revenue one year ago came in at $526.2 million.

In the call, Guild also announced that its board had approved a stock-repurchase program that will allow the company to buy back up to 20 million shares to return value to its shareholders.

Investors reacted favorably immediately after the call, pushing GHLD’s stock price to $9.99 at market opening on Friday, up 16% from its close of $8.60 the previous day. By midday, its price had fallen back to $9.16.