As

The August Mortgage Monitor report showed a 7% share of forborne borrowers held under 10% equity in their homes, giving them a higher likelihood of being foreclosed upon. Additionally, borrowers with combined loan-to-value ratios below 60% face a 30% chance of being referred to foreclosure when they could involuntarily liquidate their home through a short sale, foreclosure sale or deed-in-lieu without losing their property outright.

“We expect overall foreclosure volumes to look much more like 2018 and 2019 than they did from 2009 to 2012,” Andy Walden, Black Knight’s VP of market research, said to National Mortgage News. “The key for those borrowers is to work with their servicers to determine if there's an alternative path to get them back to performing on their loans, whether through an available deferral program, loan modification or otherwise.”

About

“It’s important to keep in mind that about a quarter of forbearances have continued their monthly payments,” Hepp said. “Based on the forbearance exits so far, only about 16% of them are without a loss mitigation plan in place.”

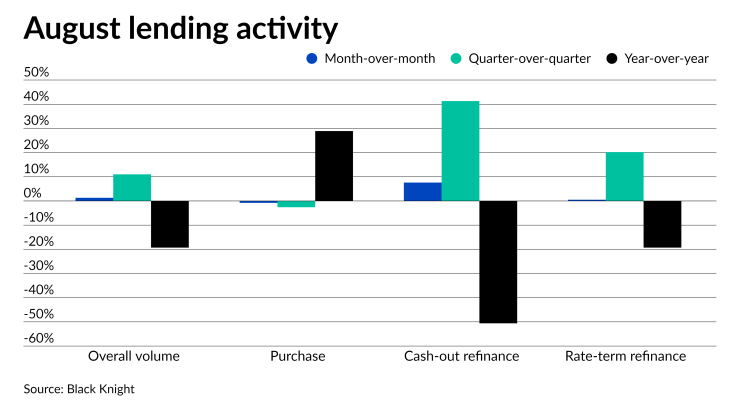

Overall, lending activity made short-term strides in August but dropped annually. Volume rose 1.3% from July, driven by a 7.6% jump in cash-out refinances while rate-and-term refinances inched up 0.5% and purchases fell 0.8%. Volume grew 11%

The overall activity dropped 19.3% year-over-year, as volumes flipped from

Out of the 20 largest metropolitan areas by origination volume in August, Phoenix saw the most growth from July, rising 9.7%. Seattle and Denver followed with gains of 5.4% and 5.3%, respectively. Six of those markets declined month-over-month, with the largest decrease coming in New York at 5.1%. It narrowed out falls of 4.1% in Washington, D.C., 3.6% in Houston and 3.1% in Chicago.