Over a year

Mortgaged homeowners amassed over $2.95 trillion in equity — putting an average of $51,470 in borrowers’ pockets — on an annual basis in 2021’s second quarter, according to CoreLogic. These surpassed the second-highest recorded totals of $1.98 trillion and $34,458

The quarter’s massive growth dropped the negative equity share to 2.3% — also a report record — from 2.6% in the first quarter and 3.3% a year ago. The aggregate unpaid principal balance fell to $268 billion from $273.2 billion quarterly and $286.8 billion annually.

The data and analytics provider expects the record levels of equity to keep building going forward and the increases will further provide distressed borrowers a buffer from foreclosure.

“For

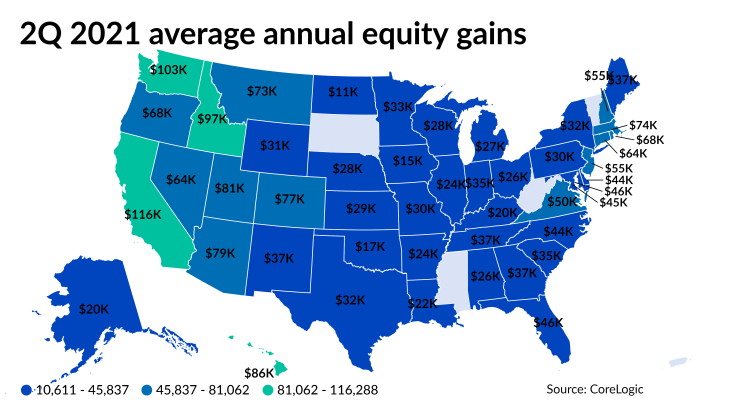

The West accounted for the largest gains at the state level. California borrowers had an average annual gain of $116,288, just beating out Washington’s average of $102,837. Rounding out the top five were Idaho with $97,013, Hawaii with $86,398 and Utah with $80,718. The smallest growth came in North Dakota at $10,611, followed by $14,713 in Iowa, $17,335 in Oklahoma and $19,914 in Alaska.

California also led the nation with the lowest percentage of underwater properties at 0.84%, closely trailed by 1.14% in Oregon and 1.16% in Arizona. Overall, 20 states had negative equity shares below 2%. Louisiana had the highest share at 7.76%, ahead of 5.19% in Iowa and 4.66% in Illinois.