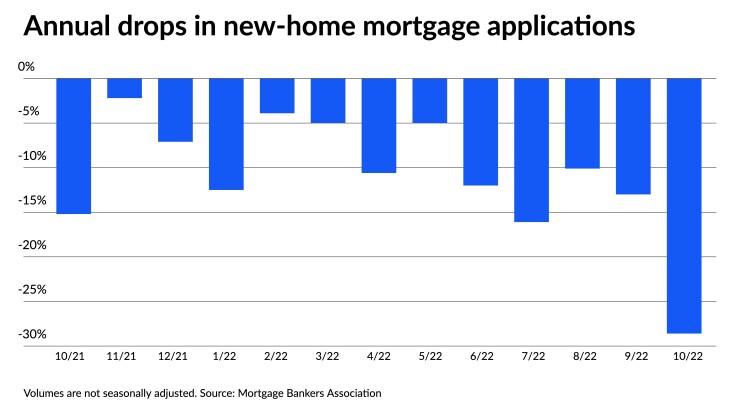

Mortgage applications for newly built single-family homes plummeted in October, corresponding with a year-long slide in homebuilder industry sentiment, as companies increasingly turn to incentives to attract customers.

The Mortgage Bankers Association's Builder Application Survey, a measure of loan application activity reported by lending subsidiaries of

"New-home purchase activity weakened on a monthly and annualized basis in October, as the sharp jump in mortgage rates to nearly 7% reduced both overall demand and the purchasing power for many prospective buyers," said Joel Kan, MBA's vice president and deputy chief economist, in a press release.

The latest drop-off showed demand

Based on MBA's October data, 47,000 new home sales transactions were made, 9.6% fewer than the 52,000 sold a month earlier. The association calculated an estimated annual seasonally adjusted sales rate of 598,000 units, the slowest pace since July, Kan said. The number represents a 6.1% decrease from September's estimated annualized sales of 637,000.

Meanwhile, in a further reflection of ongoing homebuilding trends, the U.S. Census Bureau on Thursday also reported

The fall in demand this year has quickly doused a previously hot housing market, leaving much of the home construction industry in a funk, according to results of the National Association of Home Builders' monthly confidence survey released this week.

The NAHB/Wells Fargo Housing Market Index posted a reading of 33 on a 100-point scale, the lowest mark since June 2012, with the exception of the first months of the coronavirus pandemic. A month ago, the index came in at 38, and all three components of the index — current sales, expectations and traffic — declined. Builder sentiment has now fallen for 11 months in a row.

In an effort to increase traffic and spur sales, more homebuilders reported they are now using incentives. Approximately 25% said they were currently paying points for buyers compared to 13% in September, while 27% are offering mortgage-rate buydowns, up from 19% two months ago. Meanwhile, 37% of home builders expect to cut prices in November at an average reduction of 6%. In September, only 27% were willing to slash prices.

The trends appear to be set to continue for several more months, according to David Auerbach, managing director of Armada ETF Advisors, which specializes in residential real estate investment.

"Unless a more affordable product can be delivered to end consumers or there is a reset in construction costs and mortgage rates, one can assume that we may see some further weakness as we move through the winter season," Auerbach said in a statement.

The increasing number of price drawdowns is making its way into MBA's mortgage data, which showed the average new-home mortgage size in October falling to $400,616, down 8% from its peak in April 2022, according to Kan. October's mean loan size came in 1.5% below September's average of $406,767.

"The moderation in loan amounts is attributed to slower home-price growth and buyers stepping away from higher-priced homes," Kan said. In other data released earlier this week, the MBA similarly found that

Broken down by product type, 68.6% of loan applications for new residential constructions were for conventional mortgages in October. The share of applications guaranteed by the Federal Housing Administration took a 20.1% share, while Department of Veterans Affairs-backed loans represented 11%. Applications coming from U.S. Department of Agriculture programs made up 0.3%.