Highridge Partners, Los Angeles, has launched Crestridge Investments, an El Segundo, Calif.-based real estate financing and investment company that will make private placements in operating companies with a "direct or indirect connection" to real estate, including public companies.Crestridge -- which Highridge describes as "the successor" to Haverford Capital, a real estate financing company -- will "pursue a broad strategy from equity participations to investments in operating companies." Crestridge will also provide venture capital in the real estate arena. The company has "a significant pool of capital earmarked for these new categories of proprietary investments," Highridge said. The company will be led by Chris Grey and David Feingold, Crestridge's managing directors, who are launching the firm in association with John Long, the founder of Highridge. Both Mr. Grey and Mr. Feingold are also associated with Highridge.

-

The mortgage broker trade group put out a white paper calling for lowering transaction costs, increasing housing supply and reducing regulatory barriers.

February 13 -

Fannie Mae and Freddie Mac will add loan-level buydown data to MBS this spring, giving investors clearer insight into prepayment risk tied to temporary rate incentives.

February 13 -

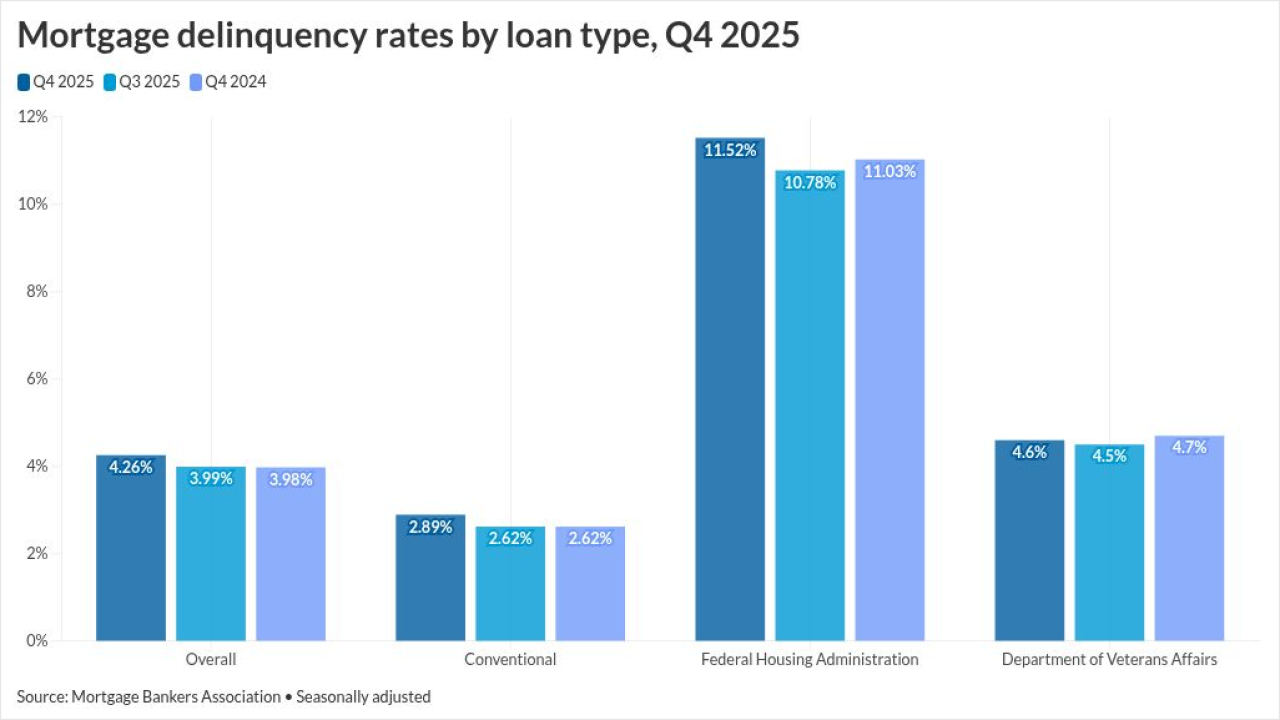

Mortgage delinquencies increased across loan types, and while 30-day late payments showed overall improvement, later-stage distress worsened.

February 13 -

The Bureau of Labor Statistics released its January Consumer Price Index Friday, showing that inflation rose 0.2%, while the annual rate eased to 2.4% after holding at 2.7% for several months. The data reduces the likelihood that the Federal Reserve will cut interest rates in the near future.

February 13 -

Hundreds of E Mortgage Capital employees, including loan officers, can opt-in to the complaint accusing the company of failing to pay them for overtime.

February 13 -

The Consumer Financial Protection Bureau's complaint portal has been flooded in recent years, but corporate debt collectors, industry attorneys and consumer advocates question whether the bureau's efforts to reduce the volume will help consumers as much as it helps the firms they're complaining about.

February 13