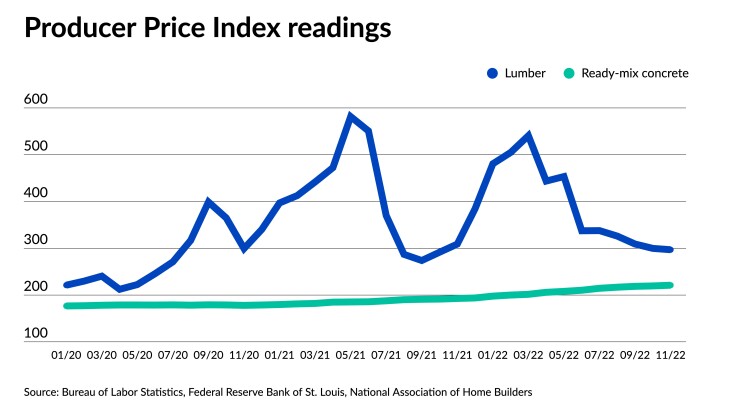

Costs for home building materials edged downward in November, decreasing for the fifth time in six months, as reduced fuel and lumber prices helped counter rising concrete and services charges, according to analysis from the National Association of Home Builders.

The U.S. Bureau of Labor Statistics'

The cost of ready-mix concrete [RMC] headed upward again for yet another month, rising 1.1% in November and 10.7% year to date. The price index for concrete has climbed higher in 21 out of the last 22 months, with costs now up 20% over that time period.

"Volatility continues to be an issue in the RMC market and is just shy of the record high set in the middle of the housing boom, said David Logan, NAHB's director of tax and trade policy analysis in a research statement. Ready-mix concrete prices reached their peak in 2006.

"The West has experienced the largest increase since January 2021 — plus 27.7% — while the smallest increase over the period has been in the Northeast," Logan said.

But

Steel mill product prices also declined 3.0 % in November after dropping 5.5% in October, while gypsum materials came in 0.5% higher following a small downward move the previous month.

Meanwhile, the price of goods in residential construction fell 0.8% on a monthly basis thanks largely due to a drop in the cost of gasoline and diesel fuel, which helped drive energy expenses down 5.3%. At the same time, the cost of services related to operations increased 0.6%, led by a surge in business-loan pricing, which went up by 14%. Costs associated with securities brokerages and dealing services also headed up 25%, while trucking and freight charges also increased.

The recent drops in the Producer Price Index has done little to improve the pessimism among home builders this year, according to the most recent survey of industry sentiment conducted by NAHB. The survey, which addresses builders' outlook based on sales, near-term expectations and customer traffic has fallen for 11 straight months, as the construction industry faces a