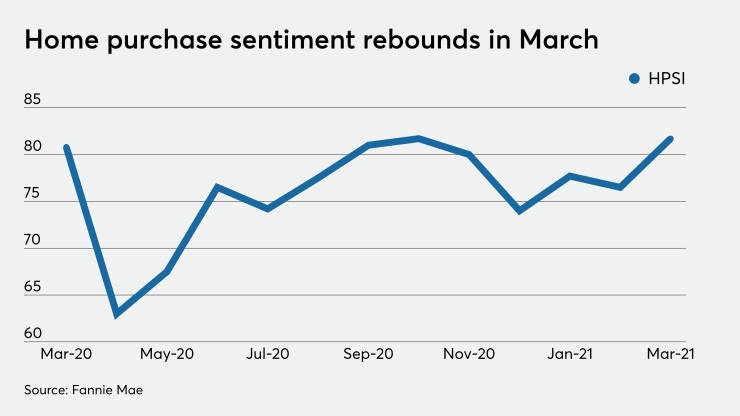

Home purchase sentiment is at its highest level since October due to three converging events: the spring buying season, increased vaccinations and stimulus checks being mailed out, Fannie Mae said.

March's Home Purchase Sentiment Index was at 81.7, an increase of 5.2 points from

"Home-selling sentiment experienced positive momentum across most consumer segments — nearly reaching pre-pandemic levels and generally indicative of a strong seller’s market," Fannie Mae Chief Economist Doug Duncan said in a press release. "Consumers once again cited high home prices and

However, while there was an increase in the net percentage of those saying it was a good time to buy in March compared with February, that metric has not recovered to pre-pandemic levels. This is because "the home buying experience continues to prove difficult for many of the same reasons, namely

There was a five percentage point month-to-month increase in the share of consumers saying it was a good time to buy a home, to 53% from 48% in February, while those saying it was a bad time to buy fell to 40% from 43%.

Meanwhile, 61% of March respondents said it was now a good time to sell, up from 55% in February. The share that said it was a bad time to sell fell to 28% from 35% in February.

Of the six components Fannie Mae uses to calculate the HPSI, the only one to decline on a net basis, unsurprisingly, was consumers' outlook on mortgage rate movements over the next 12 months.

A mere 6% of respondents said they expected mortgage rates to move downward, with 54% stating they

As to that double-edged sword of rising home prices, 50% of those participating in the March survey said they would rise over the next 12 months, while 29% said they would remain the same and 14% responding they would decline.

In February, 47% expected prices to increase, 29% felt they would remain unchanged and 18% said they would drop.