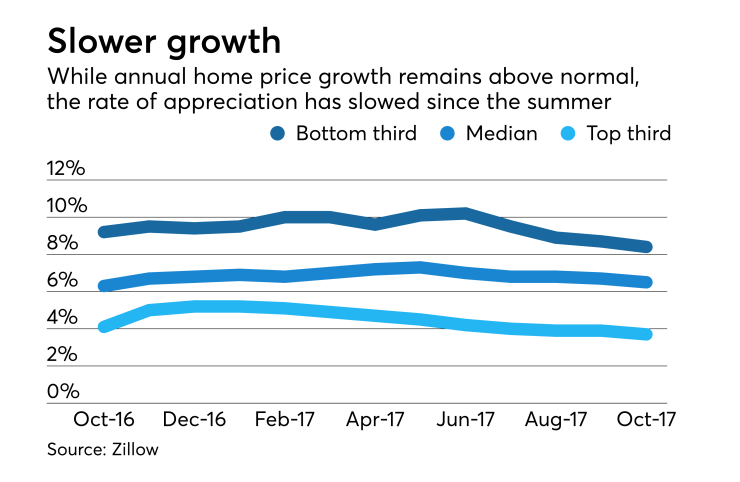

Home price appreciation continues to increase at a much higher than normal pace, although the rate of growth has been slowing since the summer.

Median home values increased by 6.5% in October, the 15th consecutive month the rate has been above 6%, according to Zillow. However since peaking at 7.3% in May, the rate of appreciation has been down or flat in the succeeding months. The median value increased by 6.7% in September and 6.5% in October 2016.

"Home values

The annual rate of growth in a normal market is around 3%, Gudell said in an accompanying blog post.

The inventory of homes for sale is 11.7% lower than it was a year ago. The lowest third of the market is particularly affected by the shortage. Of the 1.24 million homes (seasonally adjusted) listed for sale during the month, 22.3% were in the bottom third price tier, compared with 26.3% in the middle and 51.4% at the top.

As a result, for the lowest third, annual price appreciation increased 8.4%, the slowest rate since November 2015. September's rate of appreciation was 8.7% and for October 2016, it was 9.2%.

On the other hand, there was only a 3.7% annual rate of appreciation for the upper tier of homes, compared with 3.9% last month and 4.6% one year ago.