HomeStreet Bank could receive nearly $190 million in total for selling $14 billion in mortgage servicing rights to New Residential and PennyMac, and selling its home loan centers to Homebridge.

HomeStreet will be paid an aggregate $183 million for the MSRs related to single-family loans, according the bank's recent 8-K filing with the Securities and Exchange Commission.

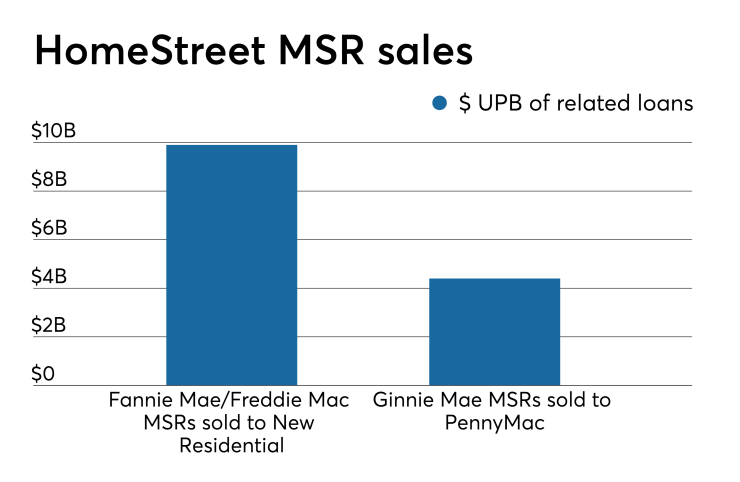

The bank is selling almost $10 billion in Fannie Mae and Freddie Mac MSRs to New Residential Investment Corp., and selling more than $4 billion in Ginnie Mae MSRs to PennyMac Loan Services. The MSRs transferred represent more than 70% of the unpaid principal balance of HomeStreet's portfolio as of Dec. 31, 2018.

HomeStreet also will initially receive nearly $5 million based on the net book value of the acquired home loan centers. In addition, Homebridge Financial Services also has agreed to pay a premium of $1 million.

"In the event Homebridge realizes a certain level of loan originations for the 12 months following the closing the asset sale, HomeStreet will be entitled to an additional payment of $1 million at that time," the bank also said in the SEC filing.

Total payments for the purchase could be reduced by up to $2 million to reimburse Homebridge for certain expenses related to the acquisition.

The MSR sales and the sale of HomeStreet's

Blue Lion Capital, an activist investor in HomeStreet, has long been concerned about the mortgage business' profitability and pushed the bank

"The sale of the home loan center-based mortgage origination business and related servicing rights will significantly reduce the size and scope of HomeStreet"s single family mortgage operation," Mark Mason, HomeStreet's chairman, president and CEO, said in a press release.

"These transactions align with our long-term strategic goal of reducing our reliance on this cyclical and volatile earnings stream and increasing our reliance on the more stable earnings from our commercial and consumer banking business. We believe our network of office locations and origination personnel complements the existing Homebridge business well," he said. "We thank those employees that are part of the transaction for their hard work."

HomeStreet plans to source mortgages for its remaining mortgage operation through its branch network, online banking services and affinity relationships after the sale of the home loan centers.