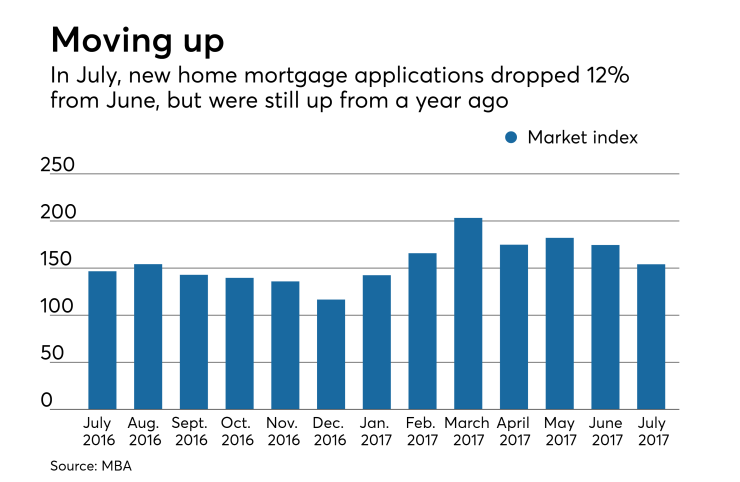

Newly constructed home purchase mortgage applications were down by 12% compared with

When compared with July 2016, there was a 5.1% increase.

Year-to-date through July, new-home loan applications are up over 7% from the same period in 2016.

By product type, 69.8% of new-home loan applications in July were conventional and 15.7% were FHA loans; VA loans made up 13.3%.

The average loan size of new homes grew from $327,833 in June to $329,483 in July.

"The year-over-year increase in applications to homebuilders for new home purchase mortgages slowed down somewhat in July, after relatively strong showings in May and June," said Lynn Fisher, MBA vice president of research and economics, in a press release.

"Nonetheless, the pattern of applications over the last three months suggests that housing starts will fall off less than expected during late summer and early fall as demand spills over from the low-inventory existing-home market into the market for new homes," she said.

New single-family home sales were running at a seasonally adjusted annual rate of 562,000 units in July, according to MBA estimates. This is a 10.5% decline from the June pace of 628,000 units.

Though new-home purchase mortgages were greater in June, applications were even stronger in

July marks the third time in four months that new-home loan activity slowed, due to the wind-down of the spring home purchase season.