New home purchase application activity bounced back in May as sales of these properties increased by 5.6% compared with April, according to the Mortgage Bankers Association.

The Mortgage Bankers Association's Builder Application Survey found loan submissions for newly constructed homes increased 4% over April and 15% compared with May 2016. In April there was

"While March has signaled the peak in applications for new homes for the last two years, we may see more sustained activity throughout the balance of this year as demand for new homes continues to increase and strong house price growth continues to motivate homebuilding," said Lynn Fisher, the MBA's vice president of economics and research, in a press release.

On an unadjusted basis, the MBA estimated there were 57,000 new homes sold in May, up 5.6% from a revised 54,000 in April.

New single-family home sales were running at a seasonally adjusted annual rate of 605,000 units in May, up 8.6% from a revised 557,000 units in April.

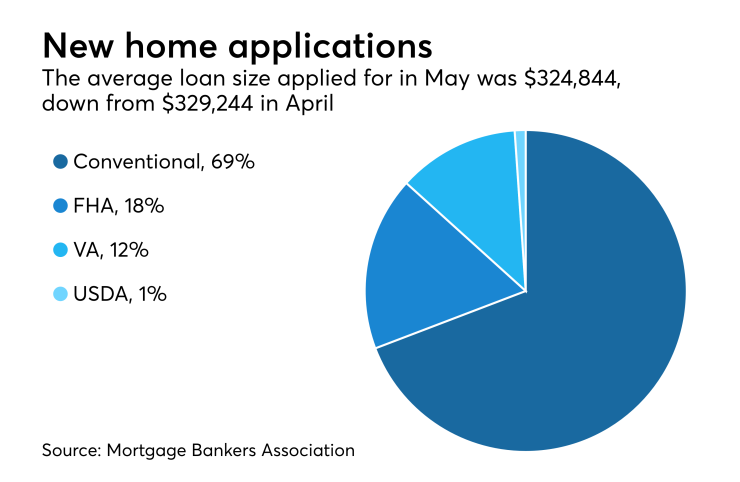

By product type, 69.2% of the applications were for conventional loans, followed by 17.5% for Federal Housing Administration-insured loans, 12.2% for Veterans Affairs-guaranteed loans and 1.1% for U.S. Department of Agriculture loans.

The average loan size decreased to $324,844 in May from a revised $329,244 in April.