The recent influx of origination volume has made lenders and industry vendors prioritize artificial intelligence that provides procedural efficiencies, but there’s more to it than that.

For example, mortgage companies with

“There are definitely a lot of opportunities for AI in cybersecurity. However, cybersecurity is probably one of the laggards when it comes to the adoption of artificial intelligence,” he said.

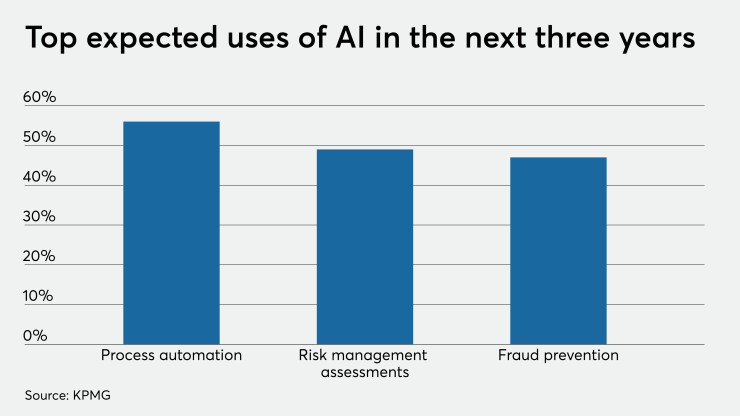

Studies bear that out. More than half of financial services professionals are looking to use AI to handle process automation in the next three years, but less than half are using it for risk management assessment or fraud prevention, according to a recent KPMG survey.

AI can be used to detect growing threats like ransomware attacks, said Aissi, who also is the chief information security officer at Ellie Mae, an origination technology division of Intercontinental Exchange.

Ransomware attacks have well-defined behaviors and AI can be used to detect those patterns, Aissi said. Many traditional cybersecurity risk-detection methods will likely be replaced by faster and more accurate artificial intelligence strategies in the next five to 10 years, he added.

Lending executives who spoke on the panel with Aissi responded by noting that while procedural improvements are their current priority, they do plan to broaden their use of AI over time.

“Ultimately we see that AI is going to touch every part of our business and we’re trying to get really prepared for that,” said Ginger Wilcox, chief experience officer at Home Point Financial.

While AI could be more broadly used in the industry in some ways, it also has its limits, noted Dan Catinella, chief digital officer at Finance of America Mortgage.

For example, while the company is using chatbots and virtual assistants to answer some of the more common questions asked by consumers and employees, it is not automating the loan-product selection process for borrowers.

“We just don’t believe that a customer should select their own product and price,” said Catinella.

Wilcox agreed that there are limits to the role AI can play in the advisory work that is part of the origination process.

“You can’t ultimately automate care and concern for your customer,” she said.