Orchard, a New York-based homebuyer and seller, has started its own mortgage company, which will offer financing for clients who purchase properties from the company.

"Orchard Home Loans is a startup within the Orchard ecosystem," a company spokesperson said. "We learned through customer research that it is valuable to offer customers the option to streamline their transaction by doing it all with Orchard. Thus, we launched Orchard Home Loans to continue to simplify the process for our customers."

Several other iBuyers, including both Zillow and Redfin, also have their own mortgage origination shops. Zillow acquired consumer-direct mortgage banker Mortgage Lenders of America — since rebranded to Zillow Home Loans — expressly for the purpose of

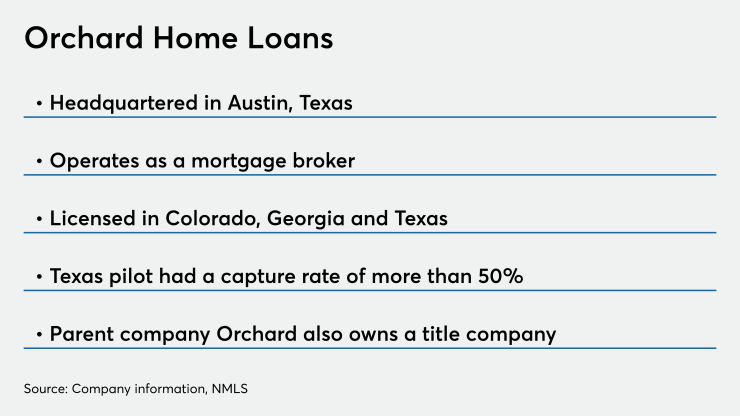

Orchard Home Loans is a mortgage brokerage based in Austin, Texas. Several other real estate firms that have

Orchard also operates a title and escrow company, Orchard Title. The company buys homes in three states: Colorado, Georgia and Texas, and holds mortgage licenses or registrations in all three, according to the Nationwide Multistate Licensing System & Registry.

Orchard Home Loans operated in pilot mode in Texas and more than 50% of Orchard's purchasers used the new company for their mortgage loan, a press release said.

"We continue to bring home buying into the modern age, by letting customers manage their transaction through a single platform, similar to what Amazon did for retail and Carvana did for car buying," the spokesperson said.

Orchard, originally known as Perch, was founded in September 2017. After completing a second Series B funding round at the start of 2020, it adopted its current name.

The company has raised $286 million in capital, including $36 million in that round from four companies, according to Crunchbase.

Navitas was the lead investor on that round, joined by Accomplice, First Mark and Juxtapose. The latter three companies were the investors in the April 2019 Series B round that raised $20 million, with First Mark as the lead. At the same time, Orchard (

Those same three companies also participated in the Series A round in May 2018 that raised $10 million in equity, while Orchard/Perch also obtained $20 million of debt financing.