Incenter Mortgage Advisors is offering a $6.1 billion portfolio of mortgage servicing rights from securitizations insured by government agency Ginnie Mae on behalf of an unnamed seller.

More than 19% of the loans involved, which average around four years of seasoning, have been removed from securitized pools because they are delinquent or in forbearance. Delinquency rates, including forbearance, break down into the following buckets: 90-plus days, 14.57%; 30-59 days, 3.81%; and 60-89 days, 1.07%

Some investors have shown interest in investing in the secondary market for mortgages in forbearance with the aim of potentially profiting if the borrower gets back on track with payments and the loan

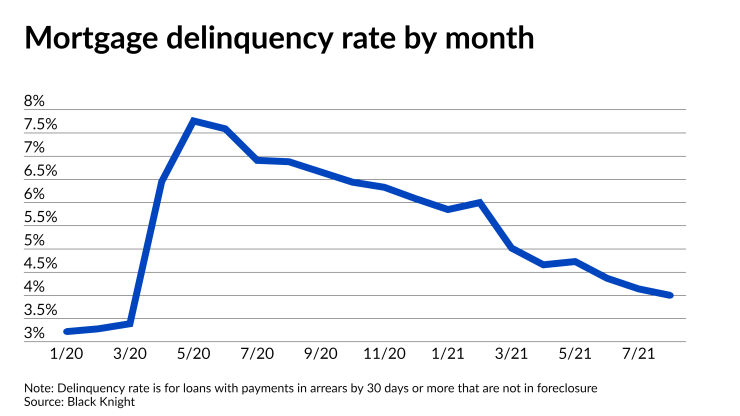

Overall, the number of mortgages that are delinquent or in forbearance, but not in foreclosure, has

The largest state concentration within the Ginnie MSRs being sold is in Florida at 9.8% of loans by count or 9.4% of the current balance. Three other states have concentrations that exceed 5%: California, Texas and New York.

Weighted averages for the fixed rate portfolio are 3.74% (coupon), 95.9% (loan-to-value ratio) and 679.7 (credit score). The average loan size is $175,178. Written bids are due on Oct. 5 at 12 p.m. Mountain time.

Other portfolios going up for bid next week in a market with increasing sales activity include nearly $3.9 billion of rights on 10- and 15-year loans from government-sponsored enterprises Fannie Mae and Freddie Mac that IMA is offering on behalf of an unnamed seller.

That package has a delinquency rate of 0.23% and an average 20 months of seasoning. Weighted averages are 2.62% (coupon), 57.8% (LTV), and 798.8 (credit score). The average loan size is $179,862. The retail origination share is 59%. The largest state concentrations by balance and count, respectively, are California (17.1%, 13.4%) and Texas (9.5, 11%). No other state concentration exceeds 5%. Written bids are due at 3 p.m. Mountain time on Oct. 5.