Fannie Mae's February mortgage origination forecast reduced its outlook by $172 billion as

Company executives alluded to the lowered projection of $3.17 trillion in

Home sales are now expected to fall by 2.4% on a year-over-year basis, up from

However, "At the same time, we expect demographic factors and a shortage of housing supply to be supportive of housing activity," Fannie Mae Chief Economist Doug Duncan said in a press release. "What remains unknown is how higher mortgage rates and tighter monetary policy — through expected interest rate hikes and changes to the makeup of the Fed's portfolio — will impact home prices."

How the Federal Reserve

"Compared to a few months ago, financial markets now expect a substantially more aggressive monetary posture from the nation’s central bank, which is likely to result in heightened volatility as the Fed retains the optionality necessary to engineer a non-inflationary soft landing," Duncan said. "We currently forecast the Consumer Price Index closing 2022 and 2023 at 4.4% and 2.5%, respectively, down from a peak of 7.6% in the current quarter."

That means inflation will remain above the 2% target at the end of 2023, despite expectations of more aggressive Fed action, Duncan continued.

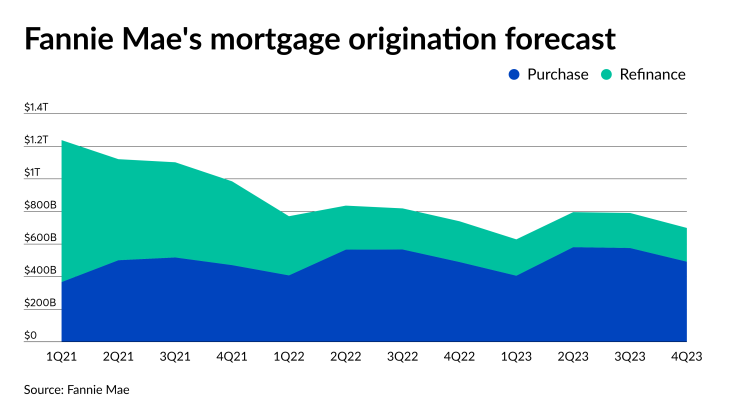

Fannie Mae made a larger adjustment to the forecast for 2023, with a reduction of $226 billion, to $2.92 trillion from $3.14 trillion. But the bulk of that is a change in refinance expectations, to $860 billion for the February outlook from $1.07 trillion for January.

However, for purchases, Fannie Mae's outlook calls for continued increases in volume, from $1.86 trillion last year to $2.03 trillion this year and $2.06 trillion in 2023.

In the February report, Fannie Mae adjusted its 2021 origination total upward by $73 billion to $4.45 trillion.