Housing affordability dropped in June for the fourth straight month as price growth broke a 16-year-old record, according to First American.

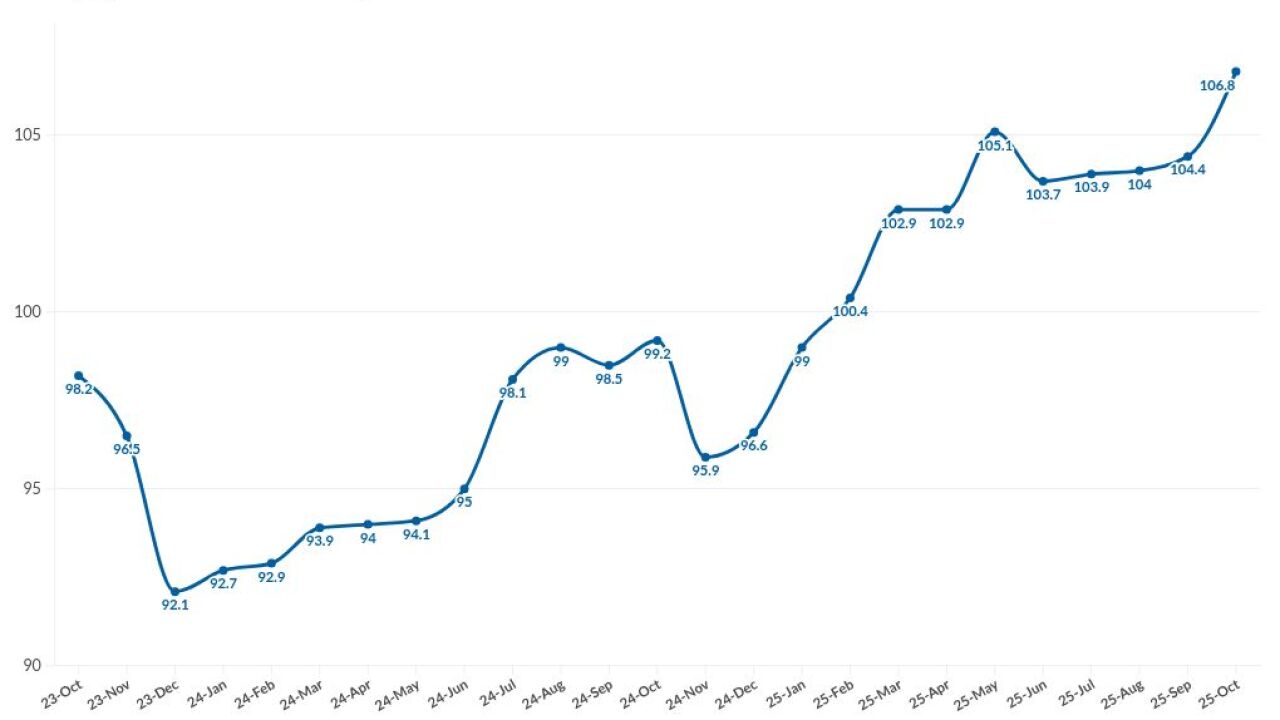

The Real House Price Index — a metric that adjusts residential property prices for income and interest rate fluctuations over time — grew 1.9% from May and

Housing prices grew 19% from June 2020, beating the record annual jump of 17.5% in 2005. Overall, home values stand 32% higher than the peak of the 2006 housing boom.

In June, median household income increased to $73,793 from $73,698 monthly and $70,737 annually.

Purchasing power went to $508,290 in June from $508,446 the month before and $475,736 in June 2020. This buying power stands 129% higher than 2006 levels.

“Looking back at the housing boom in the mid-2000s, the rapid nominal price appreciation was fueled by a surge in demand driven by wider access to mortgage financing,” Fleming said in the report. “The rapid house price appreciation in today’s housing market is largely the

While the fast-paced run up in property values from the past year provides some in the industry with worries of a coming crash, Fleming argued that not all booms end in a bust. Because of the underlying fundamentals driving the gains, declines from the current boom should be moderate and gradual as buyers pull back, he said.

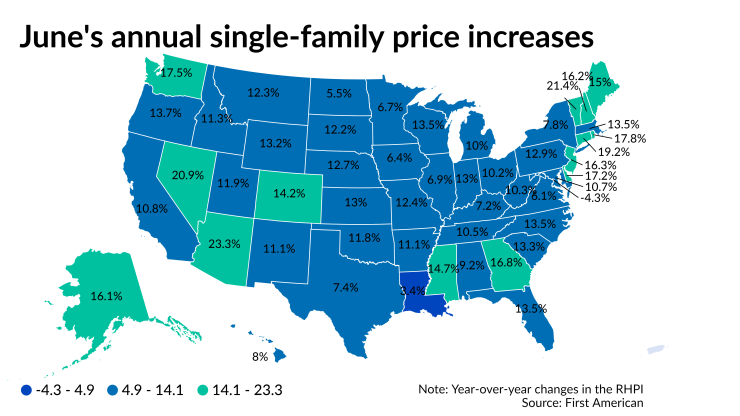

Arizona led all states with an annual rise of 23.3% in RHPI, finishing in front of Vermont’s 21.4%, Nevada’s 20.9% and Connecticut’s 19.2%. Only Washington D.C., experienced a year-over-year RHPI dip, decreasing 4.3%. Louisiana had the lowest growth at 3.4%, followed by 5.5% in North Dakota and 6.1% in Virginia.

Among the 50 largest housing markets, RHPI grew the most annually in Phoenix at 27.3%, Kansas City, Mo., at 22.6%, Las Vegas at 22.3%, Seattle at 20.5% and Tampa, Fla., at 19.8%. None of the top 50 declined from June 2020.