Commercial mortgage delinquency rates continue to improve. Aside from a small uptick in multifamily properties, they fell in May to their lowest level since the COVID-19 pandemic started, the Mortgage Bankers Association reported.

A 95.2% share of commercial and multifamily mortgage loans were current on their payments for May, up from

However, "pockets of elevated stress remain in loans backed by lodging and retail properties, driven by loans in the later-stages of delinquency and foreclosure or REO," Jamie Woodwell, vice president of commercial real estate research, said in a press release. "Quarterly measures of delinquency rates between last year’s fourth quarter and this year's first quarter show a drop in distress across nearly every capital source."

May saw a decrease in seriously delinquent commercial and multifamily mortgages — those more than 90 days late on their payments or real estate owned — to 3.1% from 3.2%.

A scant 0.2% were between 60 and 90 days late, down from 0.3% in April. But there was an increase in the 30-to-60 day late category, to 0.5% from 0.4%.

Servicers reported 1% of their loans were less than 30 days late on their payment, down from 1.1% in April.

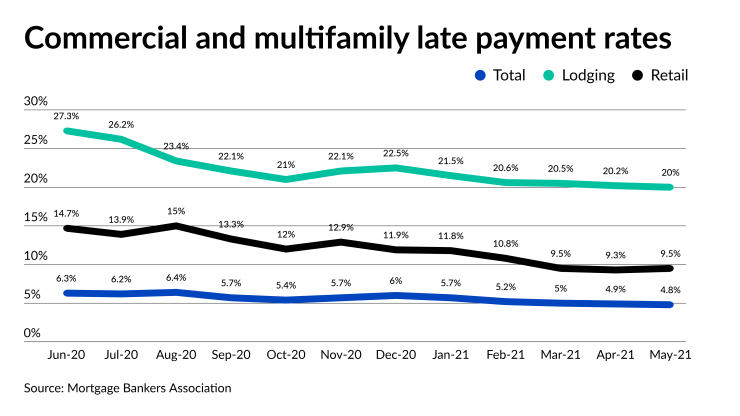

Loans secured by lodging and retail properties are still under significant stress. Fewer lodging loans were not current on their payments in May, but it was still a relatively high 20% share; in April, 20.2% of these loans were delinquent.

A higher share of retail loans were not current in May, 9.5% versus 9.3% in April.

Both categories are still performing much better than they were last June, when the share of delinquent loans sat at 27.3% for lodging and 9.3% for retail.

Only 1.8% of multifamily properties missed their May payment, but that’s up from 1.7% in April. This has been the same general range for this property type since the MBA started this survey last year.

There was an improvement in commercial mortgage-backed securities loan delinquency rates, to 8.2% in May from 8.5% in April.

However, Federal Housing Administration-insured mortgages saw a 0.3 percentage point increase in the late payment rate to 2.4% and government-sponsored enterprise mortgages had a 0.1 percentage point increase to 1.2%. Loans in life insurer portfolios had a 2% delinquency rate for May, unchanged from April.

The MBA also issued its quarterly delinquency report. Unlike the monthly data that comes from a servicer survey and reports on loans that did not make a payment that month, this report comes from the various capital providers and reflects each source's own metrics.

For CMBS, which considers loans 30 days or more late or in REO as delinquent, the rate fell to 6.3% in the first quarter, compared with 7.5% in the fourth quarter. In

For bank and thrift portfolio loans, where the measure is 90 days or more late, the first quarter's 0.8% delinquency rate was down 3 basis points from the fourth quarter, but up 29 bps on a year-over-year basis.

Fannie Mae, which includes loans in forbearance that are not current in its 60 days or more late standard, had a 32 bps

Freddie Mac does not include forborne loans in its report, had a first quarter delinquency rate of 17 bps, up 1 bp from the fourth quarter and 9 bps from the first quarter of 2020.

The 60-day-plus delinquency rate among life insurers of 0.1% was 6 bps lower than the fourth quarter but 6 bps higher than one year ago.