WASHINGTON — Lawmakers from both political parties are showing an interest in improving disclosures for loans used to upgrade home heating and cooling systems, including the installation of solar panels, an idea that has some in the industry increasingly nervous.

Members of Congress in the House and Senate have introduced bills that would require home improvement contractors to provide Truth in Lending Act disclosures to homeowners considering Property Assessment Clean Energy loans, known as PACE loans.

But PACE lenders argue the bills would impose onerous requirements on the industry, which could reduce the participation of local governments and home improvement contractors in these energy efficiency programs.

"Despite the anti-PACE rhetoric coming from the banking and mortgage industries, the fact is that PACE financing creates several benefits for them, including increased property values and expanded home financing options for new homebuyers," said Cisco DeVries, the chief executive of Renew Financial in Oakland, Calif.

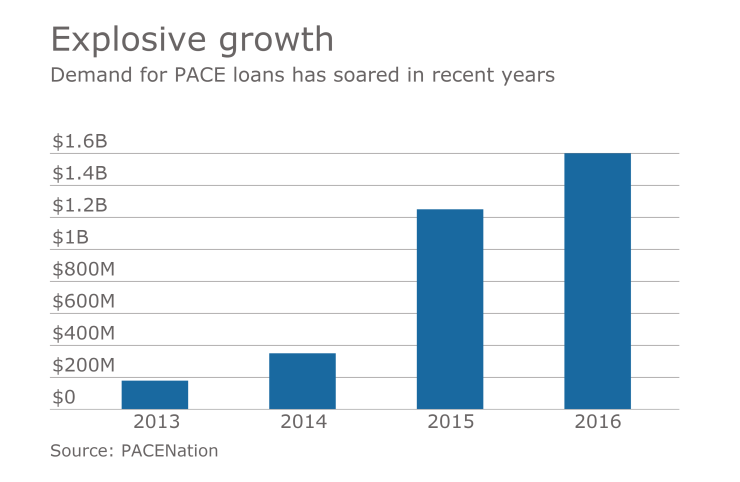

PACE loans, which enable homeowners to finance the cost of energy and water upgrades and repay as a line item on their property tax bill, are increasingly popular in states like California, where interest in solar power and alternative energy is high.

Because such loans place a lien on the homeowner's property, lenders are concerned these five- to 20-year liens could create problems with refinancing or selling a home. If the property is sold, the lien automatically transfers to the new owner.

Renew Financial supported a California bill, passed by the state legislature in September, to ensure PACE lenders provide basic disclosures to consumers. Federal lawmakers argue the new bills now in Congress would effectively do the same thing.

“Last year, California passed a law to ensure that PACE lenders provide basic disclosures to consumers," Rep. Brad Sherman, D-Calif., one of the co-sponsors of the House bill, and Rep. Ed Royce, R-Calif., said in a statement. "My bill would ensure that consumers across the country also receive the same basic disclosures."

But Renew Financial argues the federal bill is tougher since it specifically mandates TILA disclosures that are designed for larger home mortgages. The average PACE loan is about $25,000.

Renovate America, another PACE loan provider, also opposes the legislation.

The "legislation would destroy jobs and small businesses, result in higher utility bills for families, and prevent Americans from investing in their homes," J.P. McNeill, the company's CEO, said in a press release.

PACENation, a national, nonprofit organization, agrees there is a need for clear disclosures but says the bill's approach goes too far.

"Supporters of clean energy, job creation and state and local authority to solve public policy challenges should reject a legislative process being driven by banking interests that only see PACE as competition for market share," said David Gabrielson, executive director of PACENation.

Many in the mortgage and banking industries are backing the bills, including the Mortgage Bankers Association.

"PACE loans are, in substance, mortgage-related financing and should adhere to federal mortgage financing rules," David Stevens, the MBA's president, said in a press release. "This legislation will subject PACE loans to the same Truth in Lending Act consumer protections required of other applicable mortgage products."

The MBA has noted that

The group is also urging the Department of Housing and Urban Development to rescind a policy that allows the Federal Housing Administration to back loans with PACE liens attached because a delinquent PACE loan takes a first-lien position on an FHA-insured mortgage.

This "policy leaves the FHA Mutual Mortgage Insurance Fund needlessly exposed to losses brought on by delinquent PACE loan amounts," the MBA said in a March 20 letter to HUD signed by Pete Mills, an MBA senior vice president.