As the mortgage industry continues making digital strides, offering mobile device capabilities may be taking on a new meaning.

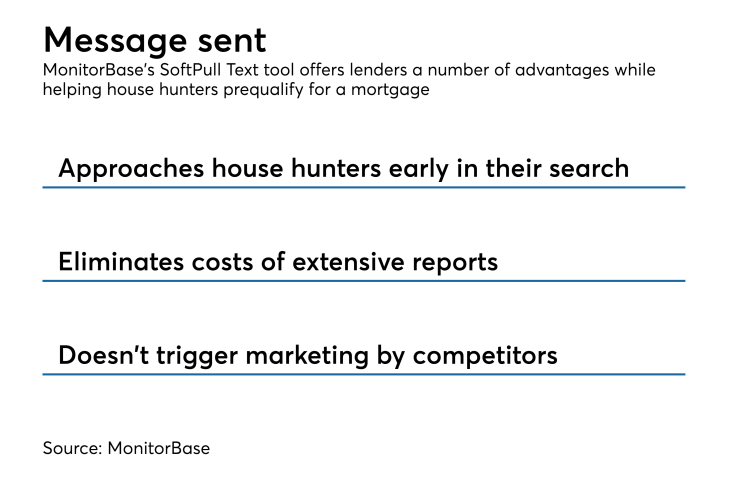

Mortgage marketing technology company MonitorBase is helping lenders prequalify consumers via text with the company's SoftPull Text tool, which provides would-be borrowers with credit and loan program details and offers lenders a low-cost source of leads.

While only a soft inquiry, clients prompted to text their name and address after typing "Go" to a MonitorBase phone number will be provided with a list of loan options they qualify for. The product release is timely, given increased focus on the purchase market from both borrowers and lenders.

As lenders increasingly invest in technologies that improve the borrower experience, the text messaging tool fills a consumer need for information early on in the home shopping process, before they're ready to commit to actually applying for a mortgage, MonitorBase said.

Because this does not entail a hard credit inquiry, it helps lenders reduce their costs of full credit reports. Each credit check will cost $2.95, and unlike other credit pulling methods, will not trigger a client to be marketed to by competitors.

"Consumers are evolving and expect answers on demand. SoftPull gives clients instant credit pre-qualification to a lender's products, early in the mortgage process. This provides both originators and their referral partner's clients the ability to text to pre-qualify anytime, anywhere," said Louis Zitting, CEO of MonitorBase, in a press release.

Alongside offering the prequalification tool directly to customers, lenders can share the MonitorBase phone number with real estate and referral partners to prompt its use. The same capabilities can also be accessed via the internet through MonitorBase's SoftPull Web, where clients enter the same limited information. The online button can also be shared with lenders' partners.

"Our pilot users are seeing very positive results and saving a bundle on credit report fees that would otherwise be wasted. Their referral partners also love that their prospects can use SoftPull to get a thumbs up on credit early in the process without a full loan application, or even a social security number," Zitting said.