Want unlimited access to top ideas and insights?

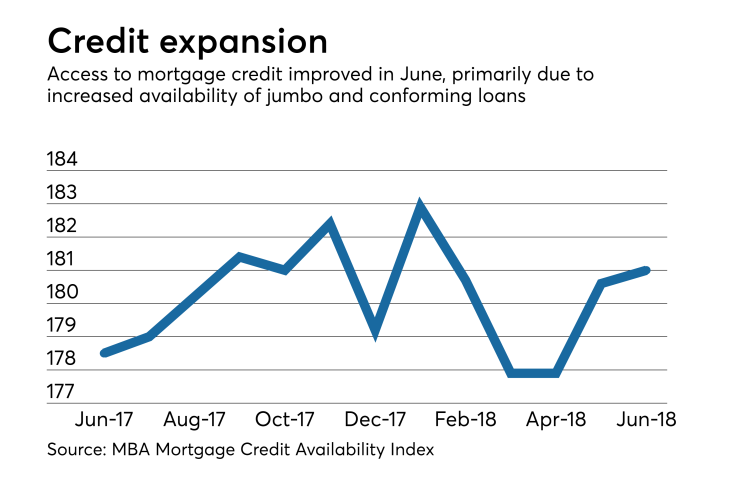

Access to mortgage credit increased slightly in June, as competition for jumbo loans resulted in looser underwriting, but government lending standards got more restrictive, the Mortgage Bankers Association said.

The MBA's Mortgage Credit Availability Index grew 0.2% in June, the

"Mortgage credit loosened slightly, led mainly by an increase in the jumbo MCAI which represented fierce competition among lenders for prime jumbo borrowers. However, this loosening was almost completely offset by a decline in credit for government loan programs," said MBA Chief Economist Mike Fratantoni said in a press release.

Access to credit for government loans has gotten more restrictive in recent months, primarily due to policy changes on the

The index tracks changes in a variety of underwriting criteria, like credit score requirements and loan-to-value ratios, to show relative changes in industrywide credit risk and access to mortgages. The index is calculated by the MBA using loan program data from Ellie Mae's AllRegs Market Clarity database.